Mathematics, 09.10.2019 16:50 dontcareanyonemo

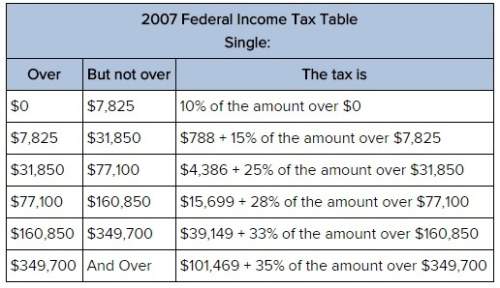

Aaron priest had a taxable income of $165,000. he figured his tax from the single taxpayer table above.

*(linked below)*

1. find his earned income level

2. entered the base amount = $

3. found the amount over $ = $

4. multiplied line 3 by % = $

5. added lines 2 and 4 = $

6. computing his monthly withholding would be = $

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 17:30

#1-20 state whether the angles are alternate interior, alternate exterior, vertical, or corresponding angles.

Answers: 2

Mathematics, 21.06.2019 17:50

Adriana sold 50 shares of a company’s stock through a broker. the price per share on that day was $22.98. the broker charged her a 0.75% commission. what was adriana’s real return after deducting the broker’s commission? a. $8.62 b. $229.80 c. $1,140.38 d. $1,149.00

Answers: 1

Mathematics, 21.06.2019 20:30

In priyas math class there are 10 boys and 15 girls. what is the ratio of boys to girls in priyas math class? express your answer as a decimal

Answers: 1

You know the right answer?

Aaron priest had a taxable income of $165,000. he figured his tax from the single taxpayer table abo...

Questions

History, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

French, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Health, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Mathematics, 05.05.2021 16:50

Chemistry, 05.05.2021 16:50

English, 05.05.2021 16:50