Mathematics, 28.01.2020 03:31 bighomie28

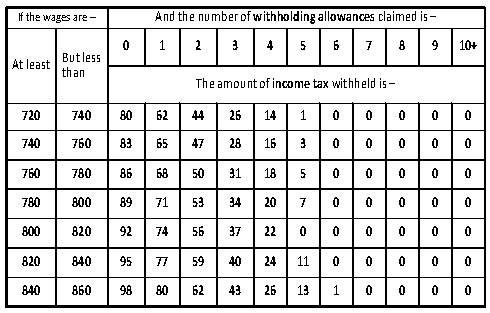

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. marilyn has all of the following deductions from her gross pay:

federal tax from the following table

2007-02-03-00-00_files/i019.jpg

social security tax that is 6.2% of her gross pay

medicare tax that is 1.45% of her gross pay

state tax that is 21% of her federal tax

determine how marilyn’s net pay will be affected if she increases her federal withholding allowances from 3 to 4.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:00

Two sides of a triangle mesure 20cm and 30cm. what is the measure of the third side

Answers: 3

Mathematics, 21.06.2019 21:00

The zoo collects $9.60 for every 24 tickets sold. how much will be collected for 400 tickets?

Answers: 2

Mathematics, 21.06.2019 21:30

Helll ! 1,400 tons of wheat of two different varieties was delivered to the silo. when processing one variety, there was 2% of waste and 3% during the processing of the second variety of wheat. after the processing, the amount of remaining wheat was 1,364 tons. how many tons of each variety of wheat was delivered to the silo?

Answers: 1

You know the right answer?

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. marilyn has al...

Questions

English, 29.01.2021 02:30

Arts, 29.01.2021 02:30

Advanced Placement (AP), 29.01.2021 02:30

Mathematics, 29.01.2021 02:30

English, 29.01.2021 02:30

Advanced Placement (AP), 29.01.2021 02:30

Mathematics, 29.01.2021 02:30

Mathematics, 29.01.2021 02:30

English, 29.01.2021 02:30

Mathematics, 29.01.2021 02:30

Social Studies, 29.01.2021 02:30