Mathematics, 24.04.2021 23:20 deasia45

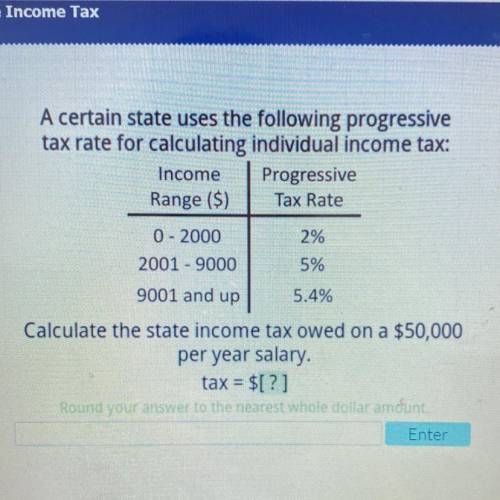

A certain state uses the following progressive

tax rate for calculating individual income tax:

Income Progressive

Range ($) Tax Rate

0 - 2000

2%

2001 - 9000 5%

9001 and up 5.4%

Calculate the state income tax owed on a $50,000

per year salary.

tax = $[?]

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 15:30

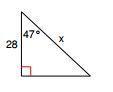

The triangles are similar. what is the value of x? show your work.

Answers: 1

Mathematics, 21.06.2019 17:00

Acylinder has volume 45π and radius 3. what is it’s height?

Answers: 2

Mathematics, 21.06.2019 20:00

The length of the line segment joining the midpoints of sides ab and bc of the parallelogram abcd is 10. find the length of diagnol ac

Answers: 3

Mathematics, 21.06.2019 21:00

The paint recipe also calls for 1/4 cup of food coloring. tyler says mrs.mcglashan will also need 6 cups of food coloring. do u agree or disagree? explain.

Answers: 2

You know the right answer?

A certain state uses the following progressive

tax rate for calculating individual income tax:

Questions

History, 09.12.2021 17:10

Spanish, 09.12.2021 17:10

Mathematics, 09.12.2021 17:10

Mathematics, 09.12.2021 17:10

Mathematics, 09.12.2021 17:10

Computers and Technology, 09.12.2021 17:10

History, 09.12.2021 17:10