Mathematics, 27.04.2021 19:20 kaylamorris05

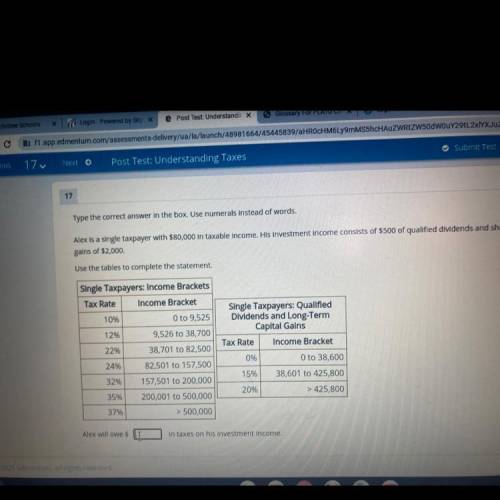

Type the correct answer in the box. Use numerals instead of words.

Alex is a single taxpayer with $80,000 in taxable income. His investment income consists of $500 of qualified dividends and short-

gains of $2,000.

Use the tables to complete the statement

Single Taxpayers: Income Brackets

Tax Rate Income Bracket

10%

0 to 9,525

Single Taxpayers: Qualified

Dividends and Long-Term

Capital Gains

Tax Rate Income Bracket

1296

9,526 to 38,700

22%

38,701 to 82,500

0%

0 to 38,600

24%

82,501 to 157,500

157,501 to 200,000

15%

32%

38,601 to 425,800

> 425,800

20%

35%

200,001 to 500,000

37%

> 500,000

in taxes on his investment income.

Alex will owe $

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 13:00

Add 1/7 + -1/7 your answer should be reduced to its smallest form and should not be an improper fraction

Answers: 1

Mathematics, 21.06.2019 20:30

Carley bought a jacket that was discounted 10% off the original price. the expression below represents the discounted price in dollars, based on x, the original price of the jacket.

Answers: 1

Mathematics, 21.06.2019 23:20

What is the slope of the line that contains the points (-5, 6) and (14. - 7)?

Answers: 1

You know the right answer?

Type the correct answer in the box. Use numerals instead of words.

Alex is a single taxpayer with...

Questions

English, 17.01.2020 19:31

Mathematics, 17.01.2020 19:31

English, 17.01.2020 19:31

Social Studies, 17.01.2020 19:31

History, 17.01.2020 19:31

History, 17.01.2020 19:31

Computers and Technology, 17.01.2020 19:31

Computers and Technology, 17.01.2020 19:31