Mathematics, 05.05.2021 08:10 WonTonBagel

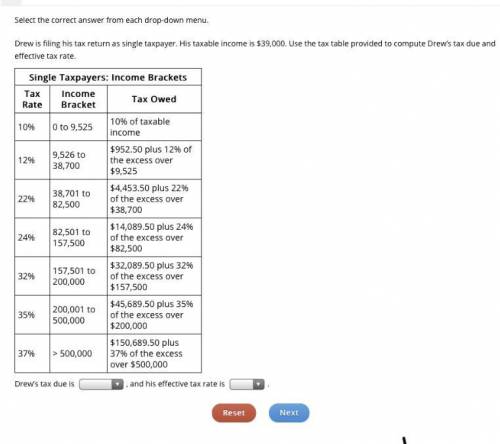

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table provided to compute Drew’s tax due and effective tax rate

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 15:30

Write the expression in simplified radical form. show all steps and work including any foil method work. (hint: use the conjugate. no decimal answers.) (9-2√3)/(12+√3)

Answers: 1

Mathematics, 21.06.2019 18:30

Divide. write in the simplest form. 4 1/6 divided by 10

Answers: 2

Mathematics, 21.06.2019 20:30

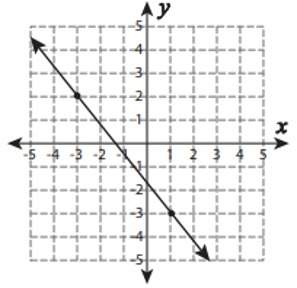

Find the solution(s) to the system of equations. select all that apply y=x^2-1 y=2x-2

Answers: 2

Mathematics, 22.06.2019 06:50

Ary throws a plastic disc to her friend, which her friend catches six seconds after mary throws it. the table shows the height of the disc at one-second intervals. assuming that the throw represents projectile motion, what are the missing values in the table? a = 5, b = 3 a = 4, b = 0 a = 4, b = 3 a = 5, b = 0

Answers: 1

You know the right answer?

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table p...

Questions

Mathematics, 20.10.2020 21:01

Health, 20.10.2020 21:01

Mathematics, 20.10.2020 21:01

Mathematics, 20.10.2020 21:01

History, 20.10.2020 21:01

Mathematics, 20.10.2020 21:01

Mathematics, 20.10.2020 21:01

Advanced Placement (AP), 20.10.2020 21:01

Arts, 20.10.2020 21:01