(PLEASE HELP I I REALLY NEED IT)

Select the correct answer from each drop-down menu.

Drew is...

Mathematics, 13.05.2021 08:00 alexisgonzales4752

(PLEASE HELP I I REALLY NEED IT)

Select the correct answer from each drop-down menu.

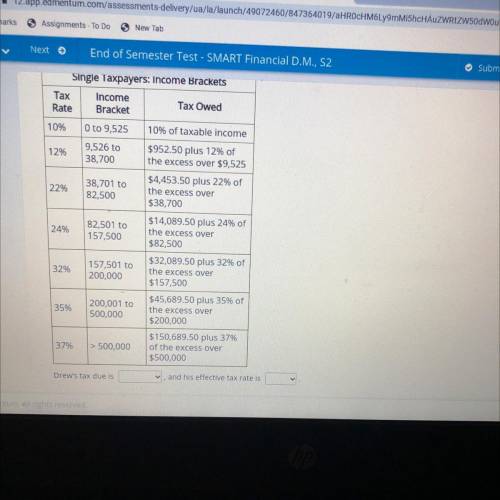

Drew is filing his tax return as single taxpayer. His taxable income is $39,000. Use the tax table provided to compute Drew's tax due and effective

tax rate.

1st drop down numbers are:

$4,519.50

$4,680.00

$5,525.25

$8,580.00

2nd drop down numbers are for the tax rate:

11.6%

12.0%

14.2%

22.0%

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:00

When solving this problem: 3025/5.5 = a/90.75 you get 49912.5 which would be the length of one of the sides of a square when the area is only 90.75 inches. is that answer correct, why, and how is it possible?

Answers: 1

Mathematics, 21.06.2019 22:00

Onnie is considering doing some long term investing with money that she inherited. she would like to have $50,000 at the end of 30 years. approximately how much money would lonnie need to put into an account earning 6% interest compounded annually in order to meet her goal?

Answers: 1

Mathematics, 22.06.2019 03:30

Millie decided to purchase a $17,000 msrp vehicle at a 4% interest rate for 6 years. the dealership offered her a $2700 cash-back incentive, which she accepted. if she takes all these factors into consideration, what monthly payment amount can she expect? a.$223.73b.$243.25c.$274.61d.$235.51

Answers: 1

Mathematics, 22.06.2019 06:00

What is the area of the regular 24-gon with radius 5 mm

Answers: 2

You know the right answer?

Questions

Social Studies, 11.02.2020 06:20

History, 11.02.2020 06:20

English, 11.02.2020 06:20

Mathematics, 11.02.2020 06:20

Mathematics, 11.02.2020 06:20

Mathematics, 11.02.2020 06:20

Geography, 11.02.2020 06:20

Mathematics, 11.02.2020 06:20

Mathematics, 11.02.2020 06:20

Mathematics, 11.02.2020 06:21

Advanced Placement (AP), 11.02.2020 06:21

History, 11.02.2020 06:21

Mathematics, 11.02.2020 06:21

Mathematics, 11.02.2020 06:21