Career:

Salary:

Income

Federal Tax Rate %

$9,326 - $37.950

15%

Let's...

Mathematics, 25.05.2021 17:50 lexirandall19

Career:

Salary:

Income

Federal Tax Rate %

$9,326 - $37.950

15%

Let's assume that you're single and live in the state of New York.

There are 5 Mandatory Payroll Tax Deductions:

$37,951 - $ 91,900

25%

• Federal income tax .

$91,901 - $191,650

28%

• State income tax

$191,651 - $416,700

33%

• Local income tax 3.8% (NYC)

• Social security tax 6.2%

Income

NY State Tax Rate %

• Medicare tax 1.45%

$21,400 - $80,650

6.45%

$80,651 - $ 215,400

6.65%

What is your state income tax rate and deduction?

State Income Tax Rate: M

Deductions: $ MO

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

Mr. and mrs. wallace have decided to buy a car for $21,600. they finance $15,000 of it with a 5-year auto loan at 2.9% arp. what will be their monthly payment be? a. $268.20 b. $268.86 c. $269.54 d. $387.16 (monthly car loan payment per $1,000 borrowed) i need !

Answers: 1

Mathematics, 21.06.2019 18:30

Divide. write in the simplest form. 4 1/6 divided by 10

Answers: 2

Mathematics, 21.06.2019 19:00

Candy lives in the center of town. her friend darlene lives 28 miles to the east and her friend dana lives 21 miles north. approximately how far do dana and darline live apart ?

Answers: 1

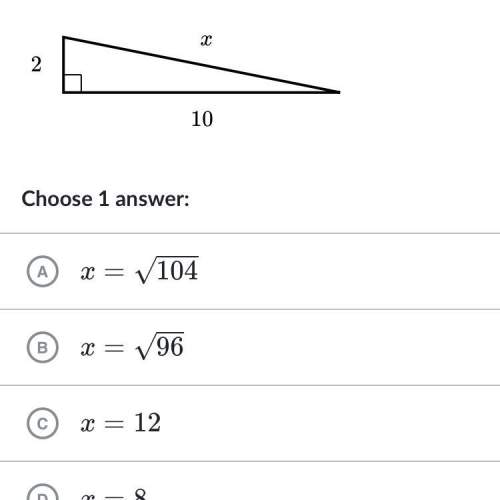

Mathematics, 21.06.2019 21:00

Askateboard ramp is in the shape of a right triangle what is the height of the ramp

Answers: 3

You know the right answer?

Questions

Mathematics, 16.04.2020 23:19

Mathematics, 16.04.2020 23:19

Mathematics, 16.04.2020 23:19

English, 16.04.2020 23:19

History, 16.04.2020 23:19

Mathematics, 16.04.2020 23:19

History, 16.04.2020 23:19

English, 16.04.2020 23:19

History, 16.04.2020 23:19