Mathematics, 03.06.2021 06:10 yusufamin876

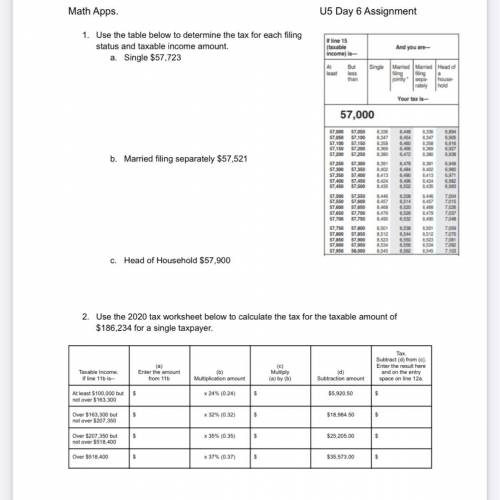

1. Use the table below to determine the tax for each filing status and taxable income amount.

a. Single $57,723

U5 Day 6 Assignment

b. Married filing separately $57,521

c. Head of Household $57,900

2. Use the 2020 tax worksheet below to calculate the tax for the taxable amount of $186,234 for a single taxpayer.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 17:30

If you apply the below transformations to the square root parent function, f(x) = vx, what is the equation of the new function? • shift 12 units right. • shift seven units down.

Answers: 1

Mathematics, 21.06.2019 17:40

An apartment has a replacement cost of $950,000 and contents valued at $1,450,000. it has a classification of a and a territory rating of 3. find the annual premium a) $10,185 b) $9,230 c) $3,155 d) $13,830

Answers: 2

Mathematics, 21.06.2019 21:30

Yesterday, george drank 1 small bottle and 2 large bottles, for a total of 1,372 grams. the day before , he drank 1 small bottle and 1 large bottle, for the total of 858 grams. how many grams does each bottle hold?

Answers: 1

You know the right answer?

1. Use the table below to determine the tax for each filing status and taxable income amount.

a. Si...

Questions

Mathematics, 29.08.2019 21:30

Mathematics, 29.08.2019 21:30

Social Studies, 29.08.2019 21:30

History, 29.08.2019 21:30

History, 29.08.2019 21:30

English, 29.08.2019 21:30

Biology, 29.08.2019 21:30

English, 29.08.2019 21:30

Mathematics, 29.08.2019 21:30

Biology, 29.08.2019 21:30

History, 29.08.2019 21:30

History, 29.08.2019 21:30