Mathematics, 23.06.2021 04:10 july00

Review the federal income tax brackets for married taxpayers filing jointly (attached in the photo)

A married couple filing jointly has a taxable income of $75,000. How much will they pay in federal income taxes?

A $7500

B.$8612

C. $6672

D. $9000

Answers: 1

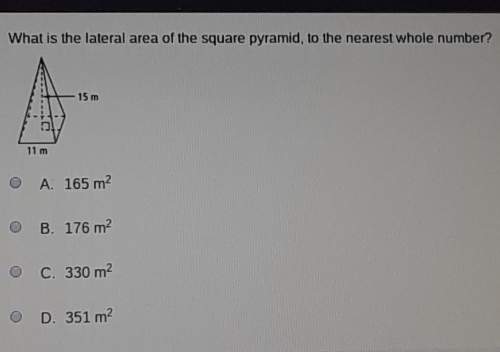

Another question on Mathematics

Mathematics, 21.06.2019 19:50

A3-dimensional figure has a square base and 4 lateral faces that meet at a point. explain the difference between the cross sections when a slice is made perpendicular to the base through the vertex, and when a slice is made perpendicular to the base and not through the vertex

Answers: 2

Mathematics, 21.06.2019 21:10

Aplane intersects a pris paralel to the base of the prism. the cross section is a polygon wth eight sides. how many sides does the base of the prism have? a. 10 b. 8 c. 7 d. 9

Answers: 1

Mathematics, 22.06.2019 00:00

Can someone plz me understand how to do these. plz, show work.in exercises 1-4, rewrite the expression in rational exponent form.[tex]\sqrt[4]{625} \sqrt[3]{512} (\sqrt[5]{4} )³ (\sqrt[4]{15} )^{7}\\ (\sqrt[3]{27} )^{2}[/tex]

Answers: 3

You know the right answer?

Review the federal income tax brackets for married taxpayers filing jointly (attached in the photo)...

Questions

Mathematics, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Computers and Technology, 05.05.2020 23:29

Spanish, 05.05.2020 23:29

Chemistry, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

History, 05.05.2020 23:29

Mathematics, 05.05.2020 23:29

Biology, 05.05.2020 23:29