Mathematics, 26.07.2021 02:10 anher

1. Assume b=0.05 is a constant for all ii in the BDT model as we assumed in the video lectures. Calibrate the ai parameters so that the model term-structure matches the market term-structure. Be sure that the final error returned by Solver is at most 10-8. (This can be achieved by rerunning Solver multiple times if necessary, starting each time with the solution from the previous call to Solver.

Once your model has been calibrated, compute the price of a payer swaption with notional $1M that expires at time t=3 with an option strike of 0. You may assume the underlying swap has a fixed rate of 3.9% and that if the option is exercised then cash-flows take place at times t=4,…,10. (The cash-flow at time t=i is based on the short-rate that prevailed in the previous period, i. e. the payments of the underlying swap are made in arrears.)

Submission Guideline: Give your answer rounded to the nearest integer. For example, if you compute the answer to be 10,456.67, submit 10457.

2. Repeat the previous question but now assume a value of b = 0.1.

Submission Guideline: Give your answer rounded to the nearest integer. For example, if you compute the answer to be 10,456.67, submit 10457.

3. Construct a n =10-period binomial model for the short-rate, ri, j. The lattice parameters are: r0,0=5%, u=1.1, d=0.9 and q=1-q=1/2. This is the same lattice that you constructed in Assignment 5. Assume that the 1-step hazard rate in node (i, j) is given by hij=abj−1/2 where a =0.01 and b =1.01. Compute the price of a zero-coupon bond with face value F =100 and recovery R =20%.

Submission Guideline: Give your answer rounded to two decimal places. For example, if you compute the answer to be 73.2367, submit 73.24.

4. The true price of 5 different defaultable coupon paying bonds with non-zero recovery are specified in worksheet Calibration in the workbook Assignment5_cds. xlsx. The interest rate is r = 5% per annum. Calibrate the six month hazard rates A6 to A16 to by minimizing the Sum Error ensuring that the term structure of hazard rates are non-decreasing. You can model the non-decreasing hazard rates by adding constraints of the form A6 ≤ A7,…,A15 ≤ A16. Report the hazard rate at time 0 as a percentage. Submission Guideline: Give your answer in percent rounded to two decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24..

5. Modify the data on the CDS pricing worksheet in the workbook bonds_and_cds. xlsx to compute a par spread in basis points for a 5yr CDS with notional principal N =10 million assuming that the expected recovery rate R =25%, the 3-month hazard rate is a flat 1%, and the interest rate is 5% per annum.

Submission Guideline: Give your answer in basis points rounded to two decimal places (1 bps = 0.01%). For example, if you compute the answer to be 73.2367 bps, submit 73.24

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:30

Beth makes batches of bluberry muffins and banna muffins. each batchis 6 muffins. she makes 2.5 batches of bluberry muffins. how many batches of bananna muffins should beth make if she wants to have a total of 60 muffins?

Answers: 1

Mathematics, 21.06.2019 18:00

Is a positive integer raised to a negative power always positive

Answers: 1

Mathematics, 21.06.2019 19:30

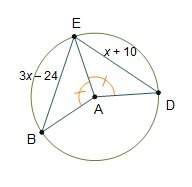

1. are the corresponding angles congruent 2. find the ratios of the corresponding sides 3. is triangle jkl congruent to triangle rst? if so what is the scale factor

Answers: 1

You know the right answer?

1. Assume b=0.05 is a constant for all ii in the BDT model as we assumed in the video lectures. Cali...

Questions

Mathematics, 12.01.2021 22:00

English, 12.01.2021 22:00

Mathematics, 12.01.2021 22:00

Arts, 12.01.2021 22:00

English, 12.01.2021 22:00

English, 12.01.2021 22:00

Mathematics, 12.01.2021 22:00

Chemistry, 12.01.2021 22:00

English, 12.01.2021 22:00

Chemistry, 12.01.2021 22:00

English, 12.01.2021 22:00

Mathematics, 12.01.2021 22:00

History, 12.01.2021 22:00