Mathematics, 31.07.2021 19:40 Madisonk3571

HIGH POINTS + BRAINLIEST

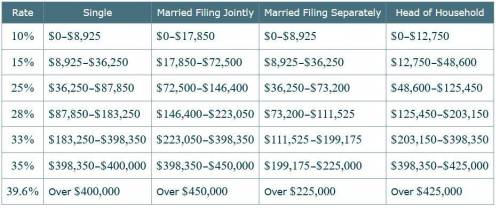

Each row shows the tax rate on a specific portion of the taxpayer's taxable income given their filing status. For example, suppose a taxpayer has a filing status of Single and a taxable income of $40,000. This means that the taxpayer owes 10% tax on the first $8,925, 15% tax on the amount over $8,925 up to $36,250, and 25% in the amount over $36,250 up to $ 40,000.

If Abdul and Maria had a filing status of Married Filing Jointly and together have a taxable income of $91,307 in the year 2013, how much did the couple owe for federal income tax?

Do not round any intermediate computations. Round your answer to the nearest dollar.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:30

What is the answer to this question? i'm a bit stumped. also how do i do it? 5(x - 4) = 2(x + 5)

Answers: 1

Mathematics, 21.06.2019 19:50

98 point question what is the record for most points in one

Answers: 2

Mathematics, 21.06.2019 21:00

Rewrite the following quadratic functions in intercept or factored form. show your work. f(t) = 20t^2 + 14t - 12

Answers: 1

Mathematics, 21.06.2019 22:00

Alex took his brother to a birthday party. the party was scheduled to last for 1 and 3/4 hours but they stayed for 4/5 of an hour more. how long did she stay at the party?

Answers: 2

You know the right answer?

HIGH POINTS + BRAINLIEST

Each row shows the tax rate on a specific portion of the taxpayer's taxabl...

Questions

History, 17.10.2020 04:01

Chemistry, 17.10.2020 05:01

History, 17.10.2020 05:01

English, 17.10.2020 05:01

Mathematics, 17.10.2020 05:01

Mathematics, 17.10.2020 05:01

Mathematics, 17.10.2020 05:01

History, 17.10.2020 05:01

Mathematics, 17.10.2020 05:01