Mathematics, 01.08.2021 14:00 angie249

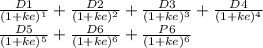

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share forever.

b) Stock B is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 4% a year forever.

c) Stock C is expected to pay a dividend of $5 next year. Thereafter, dividend growth is expected to be 20% a year for five years (i. e., until year 6) and zero thereafter. If the market capitalization rate for each stock is 10%, which stock is the most valuable? What if the capitalization rate is 7%?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 20:00

Given: ∆mop p∆mop =12+4 3 m∠p = 90°, m∠m = 60° find: mp, mo

Answers: 1

Mathematics, 21.06.2019 21:30

Write 5(6x+4)-2(5x-2) in the form a(bx+c) where a,b and c integers and a> 1

Answers: 2

Mathematics, 21.06.2019 21:50

Free points also plz look my profile and answer really stuff

Answers: 2

Mathematics, 21.06.2019 21:50

What function has a range {yly< 5}? question on picture above^

Answers: 3

You know the right answer?

Consider the following three stocks:

a) Stock A is expected to provide a dividend of $10 a share fo...

Questions

Social Studies, 05.05.2020 08:23

History, 05.05.2020 08:23

History, 05.05.2020 08:23

Mathematics, 05.05.2020 08:23

Mathematics, 05.05.2020 08:23

Mathematics, 05.05.2020 08:23

History, 05.05.2020 08:23