Mathematics, 17.08.2021 21:20 jennaranelli05

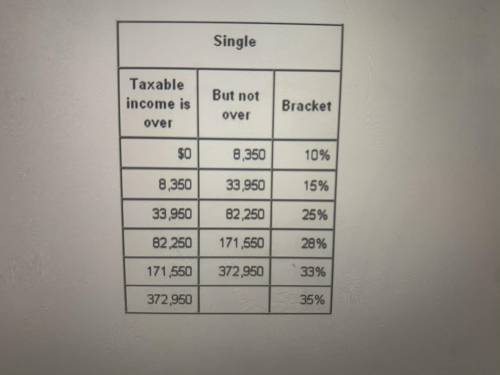

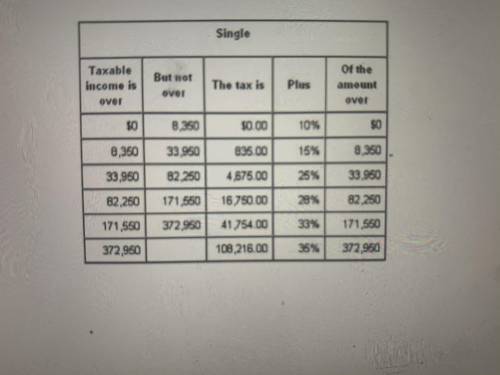

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part time as a medical assistant. Each year she filed taxes as Single, takes a standard deduction of $5700 and claims herself as only exemption for $3650. Based on this information, what tax bracket does Monica fall into? (First picture) Using the information from a previous problem, calculate the amount of taxes Monica owes. (Second picture)

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 16:00

Awall map has a scale of 128 miles = 6 inches. the distance between springfield and lakeview is 2 feet on the map. what is the actual distance between springfield and lakeview? 384 miles 512 miles 1.13 miles 42.7 miles

Answers: 1

Mathematics, 21.06.2019 17:30

Someone this asap for a group of students attends a basketball game. * the group buys x hot dogs at the concession stand for $2 each. * the group buys y drinks at the concession stand for $3 each. the group buys 29 items at the concession stand for a total of $70. how many hot dogs did the group buy?

Answers: 2

Mathematics, 21.06.2019 23:00

Which statement accurately explains whether a reflection over the y axis and a 270° counterclockwise rotation would map figure acb onto itself?

Answers: 1

You know the right answer?

Monica is an unmarried college student with no dependents. Last year, she made $14,000 working part...

Questions

Arts, 29.06.2019 20:10

Physics, 29.06.2019 20:10

Health, 29.06.2019 20:10

Advanced Placement (AP), 29.06.2019 20:10