Mathematics, 26.08.2021 22:10 mahmed78

Trudy's AGI last year was $262,000. Her Federal income tax came to $78,600, paid through both withholding and estimated payments. This year, her AGI will be $393,000, with a projected tax liability of $58,950, all to be paid through estimates. Trudy wants to pay the least amount of tax that does not incur a penalty. Assume instead that Trudy's AGI last year was $88,000 and resulted in a Federal income tax of $17,600. Determine her total estimated tax payments for this year.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 13:30

34 cup. a serving of vegetable soup is 23 cup. the restaurant sold 20 servings of chicken noodle soup and 18 servings of vegetable soup. how many more cups of chicken noodle soup did they sell than cups of vegetable soup?

Answers: 2

Mathematics, 21.06.2019 19:00

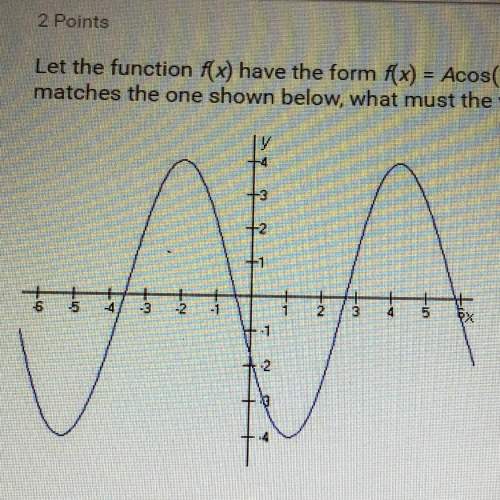

How many solutions does the nonlinear system of equations graphed bellow have?

Answers: 1

Mathematics, 21.06.2019 20:30

Aswimming pool had 2.5 million liters of water in it. some water evaporated, and then the pool only had 22 million liters of water in it. what percent of the water evaporated?

Answers: 2

Mathematics, 21.06.2019 21:00

Carmen ayer en el mercado compro 3/4 kg de guayabas, 6/8 kg de peras, 1/2 kg de naranjas ¿cuantos kilogramos de fruta compro?

Answers: 2

You know the right answer?

Trudy's AGI last year was $262,000. Her Federal income tax came to $78,600, paid through both withho...

Questions

English, 31.08.2019 00:30

Advanced Placement (AP), 31.08.2019 00:30

Health, 31.08.2019 00:30

Computers and Technology, 31.08.2019 00:30

History, 31.08.2019 00:30

Chemistry, 31.08.2019 00:30

English, 31.08.2019 00:30

History, 31.08.2019 00:30

Health, 31.08.2019 00:30

English, 31.08.2019 00:30