Mathematics, 29.09.2021 22:00 eddie6242

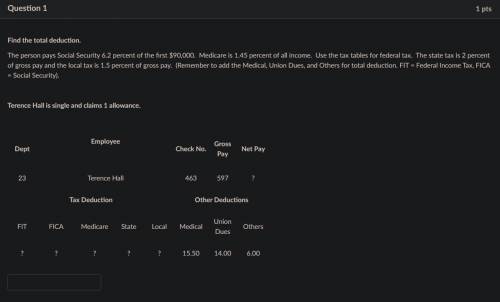

The person pays Social Security 6.2 percent of the first $90,000. Medicare is 1.45 percent of all income. Use the tax tables for federal tax. The state tax is 2 percent of gross pay and the local tax is 1.5 percent of gross pay. (Remember to add the Medical, Union Dues, and Others for total deduction. FIT = Federal Income Tax, FICA = Social Security).

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 18:30

What is the perimeter of a rectangular building that is 80 feet wide and 140 feet deep?

Answers: 1

Mathematics, 21.06.2019 22:30

Factor the polynomial, if possible. if the polynomial cannot be factored, write prime. 9n^3 + 27n^2 – 25n – 75

Answers: 2

Mathematics, 21.06.2019 23:00

Complete the conditional statement. if a + 2 < b + 3, then a < b b < a a – b < 1 a < b + 1

Answers: 3

Mathematics, 22.06.2019 00:20

Match the following reasons with the statements given to create the proof. 1. do = ob, ao = oc sas 2. doc = aob given 3. triangle cod congruent to triangle aob vertical angles are equal. 4. 1 = 2, ab = dc if two sides = and ||, then a parallelogram. 5. ab||dc if alternate interior angles =, then lines parallel. 6. abcd is a parallelogram cpcte

Answers: 2

You know the right answer?

The person pays Social Security 6.2 percent of the first $90,000. Medicare is 1.45 percent of all in...

Questions

Mathematics, 24.06.2019 22:00

Mathematics, 24.06.2019 22:00

History, 24.06.2019 22:00

Physics, 24.06.2019 22:00

Physics, 24.06.2019 22:00

History, 24.06.2019 22:00

Mathematics, 24.06.2019 22:00

English, 24.06.2019 22:00

Physics, 24.06.2019 22:00

History, 24.06.2019 22:00

History, 24.06.2019 22:00

History, 24.06.2019 22:00

Chemistry, 24.06.2019 22:00

Mathematics, 24.06.2019 22:00

History, 24.06.2019 22:00

Geography, 24.06.2019 22:00