Mathematics, 03.10.2021 20:40 cristian691023

Allie received a $50,000 distribution from her 401(k) account this year that she established while working for Big Stories, Inc. Assume that her marginal ordinary tax rate is 24 percent.

Problem 13-52 Part a (Static)

a. Allie is 45 and still employed with Big Stories, Inc. How much tax and penalty will Allie pay on the distribution?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 15:30

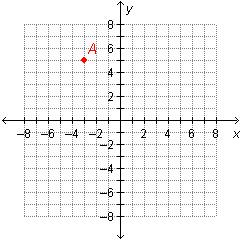

Look at the following graph of the given equation. determine whether the equation is a function. explain why or why not.

Answers: 1

Mathematics, 21.06.2019 21:30

Ok a point t on a segment with endpoints d(1, 4) and f(7, 1) partitions the segment in a 2: 1 ratio. find t. you must show all work to receive credit.

Answers: 1

Mathematics, 22.06.2019 00:00

What is the value of x in this triangle? a. 53° b. 62° c. 65° d. 118°

Answers: 2

Mathematics, 22.06.2019 02:00

Alistair has 5 half-pounds chocalate bars. it takes 1 1/2 pounds of chocalate,broken into chunks, to make a batch of cookies. how many batches can alistair mke with chocalate he has on his hand?

Answers: 1

You know the right answer?

Allie received a $50,000 distribution from her 401(k) account this year that she established while w...

Questions

Mathematics, 22.07.2019 17:00

History, 22.07.2019 17:00

Mathematics, 22.07.2019 17:00

Health, 22.07.2019 17:00

History, 22.07.2019 17:00

Mathematics, 22.07.2019 17:00