Mathematics, 11.11.2021 06:50 ImmortalEnigmaYT

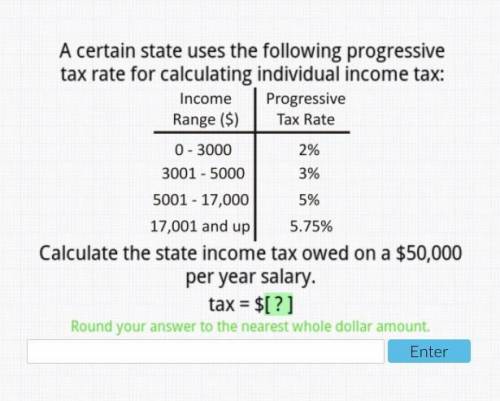

A certain state uses the following progressive tax rate for calculating individual income tax:

Income Range ($) Progressive Tax Rate

0-3000 2%

3001-5000 3%

5001-17,000 5%

17,001 and up 5.75%

Calculate the state income tax owed on a $50,000 per year salary.

tax = $[ ]

Round your answer to the nearest whole dollar amount.

*NEED HELP ASAP!*

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 14:00

F(x) = (x^2 + 3x − 4) and g (x) = (x+4) find f/g and state the domain.

Answers: 1

Mathematics, 21.06.2019 16:00

You eat 8 strawberries and your friend eats 12 strawberries from a bowl. there are 20 strawberries left. which equation and solution give the original number of strawberries?

Answers: 1

Mathematics, 21.06.2019 18:50

The number of fish in a lake can be modeled by the exponential regression equation y=14.08 x 2.08^x where x represents the year

Answers: 3

You know the right answer?

A certain state uses the following progressive tax rate for calculating individual income tax:

Inc...

Questions

Social Studies, 04.05.2021 23:00

Advanced Placement (AP), 04.05.2021 23:00

History, 04.05.2021 23:00

Mathematics, 04.05.2021 23:00

Business, 04.05.2021 23:00

Mathematics, 04.05.2021 23:00

Mathematics, 04.05.2021 23:00

Mathematics, 04.05.2021 23:00

Physics, 04.05.2021 23:00