Mathematics, 06.12.2021 20:30 ChristLover2863

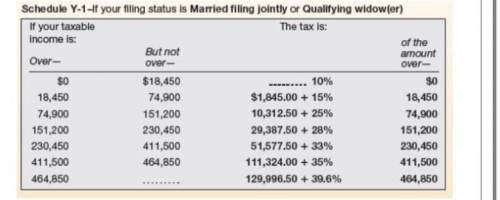

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. They were able to reduce their total income by $25,381 with deductions. Using Form 1040 and Schedule A, how much was their tax by taking these deductions? Use the schedule below.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 21:40

Asystem of linear equations contains two equations with the same slope. select all of the correct statements. i a. the system may have two solutions. - b. the system may have infinitely many solutions. c. the system may have one solution. o d. the system may have no solution. submit

Answers: 3

Mathematics, 21.06.2019 23:40

For a science project, a high school research team conducted a survey of local air temperatures. based on the results of the survey, the found that the average temperatures were around 10 degrees higher than expected. this result was wrong. the trouble with the survey was that most of the locations were exposed to direct sunlight and located over asphalt or sand, which resulted in higher temperatures than normal. this is a classic example of an error in which phase of inferential statistics?

Answers: 1

Mathematics, 22.06.2019 01:00

The graph shows how many words per minute two students read. drag to the table the unit rate that matches each graph.

Answers: 2

Mathematics, 22.06.2019 02:00

Look at the example below which shows how the product property of radicals is used to simplify a radical. use the product property of radicals to simplify the following radical.

Answers: 3

You know the right answer?

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. T...

Questions

Mathematics, 09.11.2019 22:31

Chemistry, 09.11.2019 22:31

Biology, 09.11.2019 22:31

Mathematics, 09.11.2019 22:31

Mathematics, 09.11.2019 22:31

Advanced Placement (AP), 09.11.2019 22:31

English, 09.11.2019 22:31

Chemistry, 09.11.2019 22:31

History, 09.11.2019 22:31