Mathematics, 15.12.2021 01:50 destinycasillas

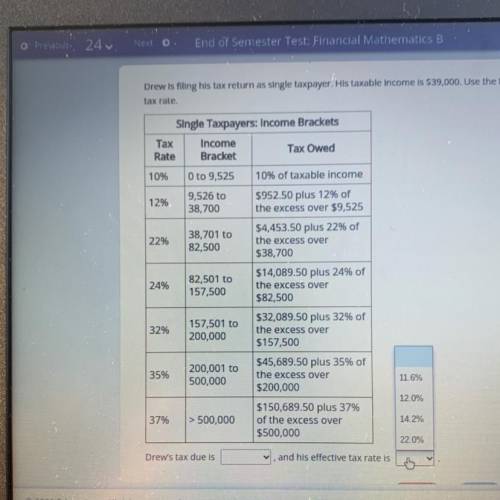

Drew is filling his tax return as single taxplayer. His taxable income is 39,000. Use the tax table provided to compute Drew’s tax due and effective tax Rate. Drew’s tax due is <4,519.50 or 4,680.00 or 5,525.25 or 8,580.00>, and his effective tax rate is <11.6% or 12.0% or 14.2% or 22.0%>

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 18:50

Find the greatest common factor of the followig monomials 21u^5v,3u^4v^6, and 3u^2v^5

Answers: 1

Mathematics, 21.06.2019 20:00

Anature center offer 2 guided walks. the morning walk is 2/3 miles. the evening walk is 3/6 mile. which is shorter

Answers: 1

Mathematics, 21.06.2019 20:10

Heather is writing a quadratic function that represents a parabola that touches but does not cross the x-axis at x = -6. which function could heather be writing? fx) = x2 + 36x + 12 = x2 - 36x - 12 f(x) = -x + 12x + 36 f(x) = -x? - 12x - 36

Answers: 1

Mathematics, 21.06.2019 21:30

Plz ( true - false) all triangles have interior angles whose measure sum to 90.

Answers: 2

You know the right answer?

Drew is filling his tax return as single taxplayer. His taxable income is 39,000. Use the tax table...

Questions

Mathematics, 03.03.2021 16:10

Spanish, 03.03.2021 16:10

Mathematics, 03.03.2021 16:10

Physics, 03.03.2021 16:10

English, 03.03.2021 16:10

English, 03.03.2021 16:10

Biology, 03.03.2021 16:10

English, 03.03.2021 16:10

Mathematics, 03.03.2021 16:10

Biology, 03.03.2021 16:10