Mathematics, 15.12.2021 20:40 silveryflight

An investor purchased one unit of a real estate limited partnership. The cost of the unit was $20,000. The investor's allocable share of nonrecourse debt was $50,000. During the first year, the investor received an income distribution of $5,000. What is the investor's current tax basis

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 16:00

You paint a 1/2 of a wall in 1/4 hour. how long will it take you to paint one wall

Answers: 2

Mathematics, 21.06.2019 20:30

Barbara has a good credit history and is able to purchase a car with a low-interest car loan. she co-signs a car loan for her friend jen, who has poor credit history. then, jen defaults on the loan. who will be held legally responsible by the finance company and why? select the best answer from the choices provided. a. barbara will be held legally responsible because she has a good credit history. b. jen will be held legally responsible because she drives the car. c. barbara will be held legally responsible because she is the co-signer. d. jen will be held legally responsible because she has a poor credit history. the answer is a

Answers: 3

Mathematics, 21.06.2019 21:00

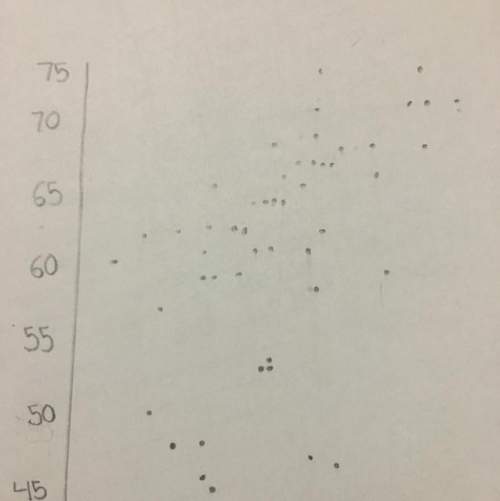

Ade and abc are similar. which best explains why the slope of the line between points a and d is the same as the slope between points a and b?

Answers: 2

You know the right answer?

An investor purchased one unit of a real estate limited partnership. The cost of the unit was $20,00...

Questions

History, 17.07.2019 22:10

English, 17.07.2019 22:10

English, 17.07.2019 22:10

Spanish, 17.07.2019 22:10

Mathematics, 17.07.2019 22:10

Chemistry, 17.07.2019 22:10

Mathematics, 17.07.2019 22:10

Mathematics, 17.07.2019 22:10

Chemistry, 17.07.2019 22:10