Mathematics, 16.12.2021 22:00 jc624826

Social Security tax that is 6.2% of his gross pay Medicare tax that is 1.45% of his gross pay state tax that is 19% of his federal tax Determine how Luis’ net pay will be affected if he increases his federal withholding allowances from 2 to 3. a. His net pay will decrease by $19.00. b. His net pay will increase by $19.00. c. His net pay will decrease by $22.61. d. His net pay will increase by $22.61.

Answers: 3

Another question on Mathematics

Mathematics, 21.06.2019 12:30

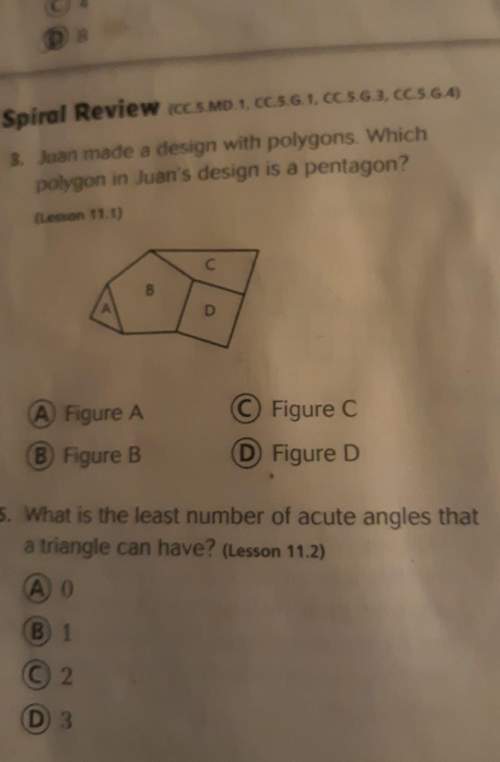

Which triangles area would be calculated using the trigonometric area formula

Answers: 1

Mathematics, 21.06.2019 14:00

Aright triangle has an area of 18 square inches. b: if the triangle is not an isosceles triangle, what are all the possible lengths of the legs, if the lengths are whole numbers. answer !

Answers: 1

Mathematics, 21.06.2019 17:00

Find the value of the variable and the length of each secant segment.

Answers: 1

You know the right answer?

Social Security tax that is 6.2% of his gross pay Medicare tax that is 1.45% of his gross pay state...

Questions

Mathematics, 27.10.2020 22:20

Social Studies, 27.10.2020 22:20

Spanish, 27.10.2020 22:20

Mathematics, 27.10.2020 22:20

History, 27.10.2020 22:20

Mathematics, 27.10.2020 22:20

English, 27.10.2020 22:20