Mathematics, 12.03.2022 14:00 juniorvalencia4

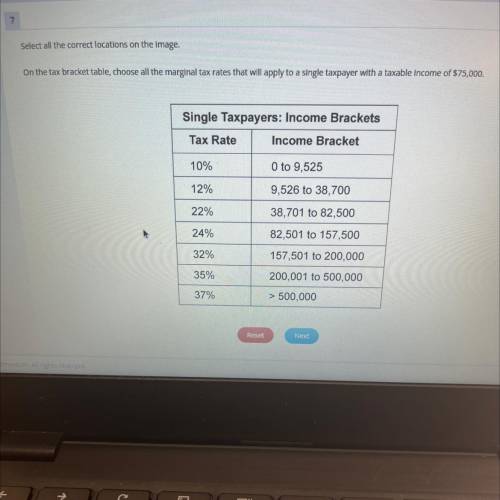

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer with a taxable income of $75,000.

Single Taxpayers: Income Brackets

Tax Rate

Income Bracket

10%

O to 9,525

12%

9,526 to 38,700

22%

38,701 to 82,500

24%

82,501 to 157,500

32%

157,501 to 200,000

35%

200,001 to 500,000

37%

> 500,000

Reset

Next

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 13:00

20 points! asap! a is known to be 6,500 feet above sea level; ab = 600 feet. the angle at a looking up at p is 20°. the angle at b looking up at p is 35°. how far above sea level is the peak p? find the height of the mountain peak to the nearest foot. height above sea level =

Answers: 1

Mathematics, 21.06.2019 18:30

Atriangle with all sides of equal length is a/an triangle. a. right b. scalene c. equilateral d. isosceles

Answers: 2

Mathematics, 21.06.2019 20:30

Aswimming pool had 2.5 million liters of water in it. some water evaporated, and then the pool only had 22 million liters of water in it. what percent of the water evaporated?

Answers: 2

Mathematics, 21.06.2019 21:00

Suppose a gym membership has an initial enrollment fee of $75 and then a fee of $29 a month. which equation models the cost, c, of the gym membership for m months?

Answers: 1

You know the right answer?

On the tax bracket table, choose all the marginal tax rates that will apply to a single taxpayer wit...

Questions

Health, 21.06.2020 04:57

English, 21.06.2020 04:57

Mathematics, 21.06.2020 04:57

Mathematics, 21.06.2020 04:57

Chemistry, 21.06.2020 04:57

Mathematics, 21.06.2020 04:57

Chemistry, 21.06.2020 04:57

History, 21.06.2020 04:57

Medicine, 21.06.2020 04:57