Mathematics, 07.04.2022 02:40 shradhwaip2426

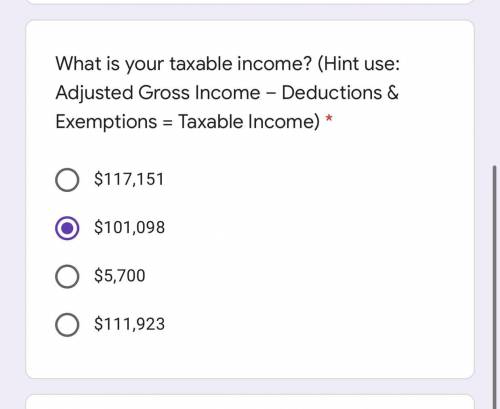

You have a gross income of $117,151 and are filing your tax return singly. You claim one exemption and can take a deduction of $2,713 for interest on your mortgage, an adjustment of $2,791 for business losses, an adjustment of $1,346 for alimony, a deduction of $2,086 for property taxes, a deduction of $2,376 for contributions to charity, and an adjustment of $1,091 for contributions to your retirement fund. The standard deduction for a single filer is $5,700, and exemptions are each worth $3,650.

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 17:00

The size of a certain cell is 2.5*10^-9m. another cell is 1.5*10^3 times larger. how large is the larger cell in scientific notation?

Answers: 2

Mathematics, 21.06.2019 17:30

Which of the following is true for the relation f(x)=2x^2+1

Answers: 3

Mathematics, 21.06.2019 19:30

Identify the number as a rational or irrational.explain. 127

Answers: 1

You know the right answer?

You have a gross income of $117,151 and are filing your tax return singly. You claim one exemption a...

Questions

Computers and Technology, 19.08.2019 10:30

History, 19.08.2019 10:30

Physics, 19.08.2019 10:30

Biology, 19.08.2019 10:30

English, 19.08.2019 10:30

Mathematics, 19.08.2019 10:30

Mathematics, 19.08.2019 10:30

Mathematics, 19.08.2019 10:30

English, 19.08.2019 10:30

Mathematics, 19.08.2019 10:30

Mathematics, 19.08.2019 10:30

English, 19.08.2019 10:30