Mathematics, 03.07.2019 07:40 live4dramaoy0yf9

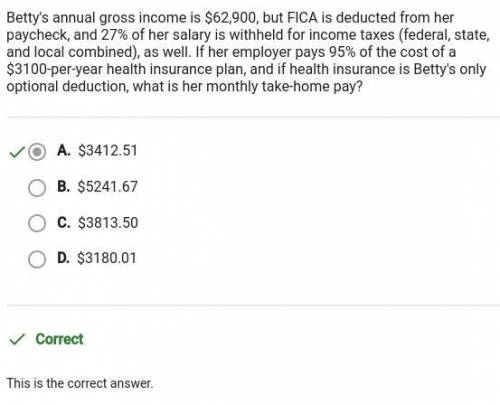

Betty's annual gross income is $62,900, but fica is deducted from her paycheck, and 27% of her salary is withheld for income taxes (federal, state, and local combined), as well. if her employer pays 95% of the cost of a $3100-per-year health insurance plan, and if health insurance is betty's only optional deduction, what is her monthly take-home pay?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 22:40

(10. in the figure, a aabc is drawn tocircumscribe a circle of radius 3 cm ,such thatthe segments bd and dc are respectively oflength 6 cm and 9 cm. find the length ofsides ab and ac.

Answers: 3

Mathematics, 21.06.2019 23:00

Describe the end behavior of the function below. f(x)=(2/3)^x-2 a. as x increases, f(x) approaches infinity. b. as x decreases, f(x) approaches 2. c. as x increases, f(x) approaches -2. d. as x decreases, f(x) approaches negative infinity.

Answers: 1

Mathematics, 22.06.2019 03:30

Right triangle abc has three sides with lengths ab= 119, bc = 169, ca= 120. find the value of cos c. hint: draw and label the triangle. the hypotenuse is always the longest.

Answers: 2

You know the right answer?

Betty's annual gross income is $62,900, but fica is deducted from her paycheck, and 27% of her salar...

Questions

History, 05.12.2019 20:31

Chemistry, 05.12.2019 20:31

Health, 05.12.2019 20:31

Mathematics, 05.12.2019 20:31

English, 05.12.2019 20:31

History, 05.12.2019 20:31

Biology, 05.12.2019 20:31

Mathematics, 05.12.2019 20:31

Mathematics, 05.12.2019 20:31

Social Studies, 05.12.2019 20:31