Mathematics, 04.07.2019 08:30 AM28

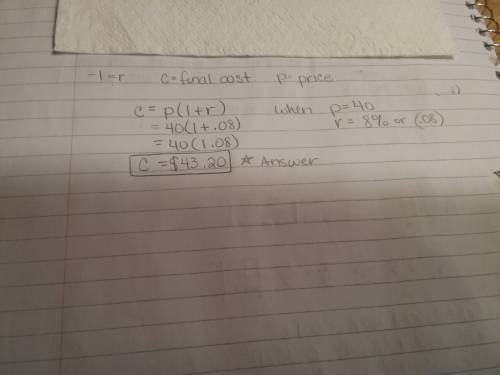

The tax rate as a percent, r, charged on an item can be determined using the formula – 1 = r, where c is the final cost of the item and p is the price of the item before tax. louise rewrites the equation to solve for the final cost of the item: c = p(1 + ). what is the final cost of a $40 item after an 8% tax is applied?

Answers: 1

Another question on Mathematics

Mathematics, 21.06.2019 14:10

Olivia uses the work below to determine 55% of 720 which explains the error in olivia’s solution

Answers: 1

Mathematics, 21.06.2019 20:30

Explain how you divide powers with like bases.discuss why the bases have to be the same.how are these rules similar to the rules for multiplying powers with like bases.

Answers: 1

Mathematics, 21.06.2019 23:30

Apyramid fits exactly inside a cube. the cube and the pyramid share the same square base, and they are both exactly the same height. the volume of the cube is 66 cubic inches. what is the volume of the pyramid? explain your answer. answer asap

Answers: 1

Mathematics, 22.06.2019 00:00

Can someone plz me understand how to do these. plz, show work.in exercises 1-4, rewrite the expression in rational exponent form.[tex]\sqrt[4]{625} \sqrt[3]{512} (\sqrt[5]{4} )³ (\sqrt[4]{15} )^{7}\\ (\sqrt[3]{27} )^{2}[/tex]

Answers: 3

You know the right answer?

The tax rate as a percent, r, charged on an item can be determined using the formula – 1 = r, where...

Questions

English, 23.05.2020 01:07

Geography, 23.05.2020 01:07

English, 23.05.2020 01:07

Mathematics, 23.05.2020 01:07

Social Studies, 23.05.2020 01:07

History, 23.05.2020 01:07

Chemistry, 23.05.2020 01:07

Mathematics, 23.05.2020 01:07

Mathematics, 23.05.2020 01:07

Mathematics, 23.05.2020 01:07