Mathematics, 27.01.2020 21:31 lordcaos066

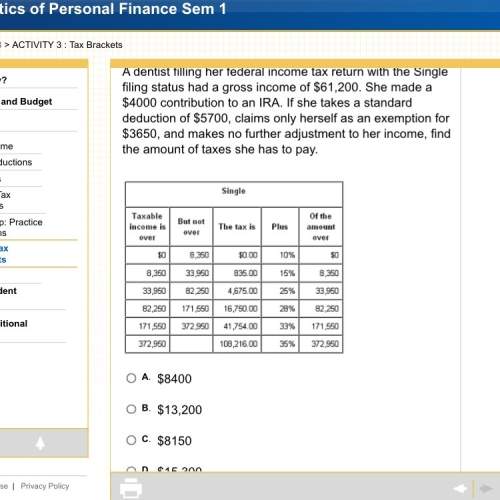

Adentist filling her federal income tax return with the single filing status had a gross income of $61,200. she made a $4000 contribution to an ira. if she takes a standard deduction of $5700, claims only herself as an exemption for $3650, and makes no further adjustment to her income, find the amount of taxes she has to pay.

Answers: 2

Another question on Mathematics

Mathematics, 21.06.2019 19:00

What are the solutions of the equation? 5z^2 + 9z - 2 = 0 a. 1, -2 b. 1, 2 c. 1/5, -2 d. 1/5, 2

Answers: 2

Mathematics, 21.06.2019 19:10

Which of the following is the shape of a cross section of the figure shown below

Answers: 3

Mathematics, 21.06.2019 23:00

Solve the system of equations using the linear combination method. {4x−3y=127x−3y=3 enter your answers in the boxes.

Answers: 1

Mathematics, 21.06.2019 23:50

The functions f(x) and g(x) are shown in the graph f(x)=x^2 what is g(x) ?

Answers: 2

You know the right answer?

Adentist filling her federal income tax return with the single filing status had a gross income of $...

Questions

Chemistry, 10.12.2021 23:50

History, 10.12.2021 23:50

Mathematics, 10.12.2021 23:50

Chemistry, 10.12.2021 23:50

Mathematics, 10.12.2021 23:50

Mathematics, 10.12.2021 23:50

English, 10.12.2021 23:50

Chemistry, 10.12.2021 23:50

Health, 10.12.2021 23:50