Physics, 10.03.2020 08:04 denisefaircloth73

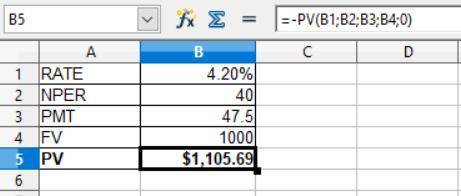

Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon rate of 9.5%. The bond has a face value of $1,000, and it makes semiannual interest payments. If you require an 8.4% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond? Group of answer choices $1,133.34 $1,105.69 $1,190.71 $1,161.67 $1,220.48

Answers: 1

Another question on Physics

Physics, 21.06.2019 23:30

In order for the bug to fly through the air a force has to push the bug forward. identify this force. how does the bug produce

Answers: 1

Physics, 22.06.2019 01:50

Arod of some material 0.20 m long elongates 0.20 mm on heating from 21 to 120°c. determine the value of the linear coefficient of thermal expansion [in (degrees c)^-1] for this material.

Answers: 2

Physics, 22.06.2019 03:50

The force acting on a beam was measured under the same operating conditions and a sample of 5 data points was collected. this process was repeated by 3 observers. the pooled standard deviations of these 3 data sets was 1.21. determine the true mean force using all pooled data (with a 95% probability). the result should look like this: true mean = mean +/- margin of error

Answers: 1

Physics, 22.06.2019 05:40

The difference between a red shift and a blue shift has to do with wavelength frequency. t or f

Answers: 1

You know the right answer?

Assume that you are considering the purchase of a 20-year, noncallable bond with an annual coupon ra...

Questions

Mathematics, 01.09.2020 22:01

English, 01.09.2020 22:01

History, 01.09.2020 22:01

History, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01

Business, 01.09.2020 22:01

Business, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01

English, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01

Mathematics, 01.09.2020 22:01