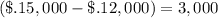

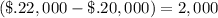

Rachel's recordings reported net income of $200,000. beginning balances in accounts receivable and accounts payable were $15,000 and $20,000, respectively. ending balances in these accounts were $12,000 and $22,000, respectively. assuming that all relevant information has been presented, rachel's cash flows from operating activities would be

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Business, 22.06.2019 03:30

Eagle sporting goods reported the following data at july ​31, 2016​, with amounts adapted in​ thousands: ​(click the icon to view the income​ statement.) ​(click the icon to view the statement of retained​ earnings.) ​(click the icon to view the balance​ sheet.) 1. compute eagle​'s net working capital. 2. compute eagle​'s current ratio. round to two decimal places. 3. compute eagle​'s debt ratio. round to two decimal places. do these values and ratios look​ strong, weak or​ middle-of-the-road? 1. compute eagle​'s net working capital. total current assets - total current liabilities = net working capital 99400 - 30000 = 69400 2. compute eagle​'s current ratio. ​(round answer to two decimal​ places.) total current assets / total current liabilities = current ratio 99400 / 30000 = 3.31 3. compute eagle​'s debt ratio. ​(round answer to two decimal​ places.) total liabilities / total assets = debt ratio 65000 / 130000 = 0.50 do these ratio values and ratios look​ strong, weak or​ middle-of-the-road? net working capital is ▾ . this means ▾ current assets exceed current liabilities current liabilities exceed current assets and is a ▾ negative positive sign. eagle​'s current ratio is considered ▾ middle-of-the-road. strong. weak. eagle​'s debt ratio is considered ▾ middle-of-the-road. strong. weak. choose from any list or enter any number in the input fields and then continue to the next question.

Answers: 3

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 23:50

The sarbanes-oxley act was passed to question 6 options: prevent fraud at public companies. replace all of the old accounting procedures with new ones. improve the accuracy of the company's financial reporting. both a and c

Answers: 3

You know the right answer?

Rachel's recordings reported net income of $200,000. beginning balances in accounts receivable and a...

Questions

Mathematics, 08.01.2020 20:31

Mathematics, 08.01.2020 20:31

History, 08.01.2020 20:31

Mathematics, 08.01.2020 20:31

Mathematics, 08.01.2020 20:31

Mathematics, 08.01.2020 20:31

History, 08.01.2020 20:31