Business, 02.08.2019 23:10 Calebmf9195

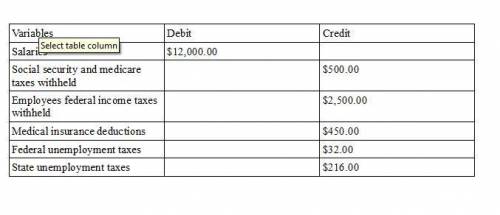

The following totals for the month of april were taken from the payroll register of tapper company. salaries $12,000social security and medicare taxes withheld 550employees federal income taxes withheld 2,500medical insurance deductions 450federal unemployment taxes 32state unemployment taxes 216

the journal entry to record the monthly payroll on april 30 would include aa. debit to salaries payable for $8,500.b. debit to salaries expense for $8,500.c. debit to salaries payable for $8,252.d. debit to salaries expense for $12,000.

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Acompany factory is considered which type of resource a.land b.physical capital c.labor d.human capital

Answers: 2

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 22.06.2019 18:10

Consumers who participate in the sharing economy seem willing to interact with total strangers. despite safety and privacy concerns, what do you think is the long-term outlook for this change in the way we think about interacting with people whom we don't know? how can businesses to diminish worries some people may have about these practices?

Answers: 1

You know the right answer?

The following totals for the month of april were taken from the payroll register of tapper company....

Questions

Engineering, 05.01.2021 01:00

Geography, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

History, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

History, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

English, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

Mathematics, 05.01.2021 01:00

History, 05.01.2021 01:00