Business, 10.09.2019 18:30 bensleytristap93y8q

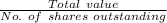

Consider a mutual fund with $260 million in assets at the start of the year and 10 million shares outstanding. the fund invests in a portfolio of stocks that provides dividend income at the end of the year of $2.5 million. the stocks included in the fund's portfolio increase in price by 9%, but no securities are sold and there are no capital gains distributions. the fund charges 12b-1 fees of 1.00%, which are deducted from portfolio assets at year-end. what is the net asset value at the start and end of the year?

Answers: 2

Another question on Business

Business, 21.06.2019 14:20

Xt year baldwin plans to include an additional performance bonus of 0.25% in its compensation plan. this incentive will be provided in addition to the annual raise, if productivity goals are reached. assuming the goals are reached, how much will baldwin pay its employees per hour?

Answers: 2

Business, 22.06.2019 04:10

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 06:20

About time delivery co. incurred the following costs related to trucks and vans used in operating its delivery service: classify each of the costs as a capital expenditure or a revenue expenditure. 1. changed the oil and greased the joints of all the trucks and vans. 2. changed the radiator fluid on a truck that had been in service for the past four years. 3. installed a hydraulic lift to a van. 4. installed security systems on four of the newer trucks. 5. overhaul the engine on one of the trucks purchased three years ago. 6. rebuilt the transmission on one of the vans that had been driven 40,000 miles. the van was no longer under warranty. 7. removed a two-way radio from one of the trucks and installed a new radio with a greater range of communication. 8. repaired a flat tire on one of the vans. 9. replaced a truck's suspension system with a new suspension system that allows for the delivery of heavier loads. 10. tinted the back and side windows of one of the vans to discourage theft of contents.

Answers: 1

Business, 22.06.2019 07:00

For the past six years, the price of slippery rock stock has been increasing at a rate of 8.21 percent a year. currently, the stock is priced at $43.40 a share and has a required return of 11.65 percent. what is the dividend yield? 3.20 percent 2.75 percent 3.69 percent

Answers: 3

You know the right answer?

Consider a mutual fund with $260 million in assets at the start of the year and 10 million shares ou...

Questions

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

English, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

English, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Arts, 20.01.2021 23:20

Social Studies, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

Mathematics, 20.01.2021 23:20

History, 20.01.2021 23:20

English, 20.01.2021 23:20