Business, 10.09.2019 22:30 jessemartinez1

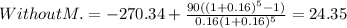

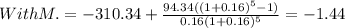

Nelectric utility is considering a new power plant in northern arizona. power from the plant would be sold in the phoenix area, where it is badly needed. because the firm has received a permit, the plant would be legal; but it would cause some air pollution. the company could spend an additional $40 million at year 0 to mitigate the environmental problem, but it would not be required to do so. the plant without mitigation would cost $270.34 million, and the expected cash inflows would be $90 million per year for 5 years. if the firm does invest in mitigation, the annual inflows would be $94.34 million. unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. the risk adjusted wacc is 16%. calculate the npv and irr with mitigation. round your answers to two decimal places. enter your answer for npv in millions. for example, an answer of $10,550,000 should be entered as 10.55. npv $ million irr % calculate the npv and irr without mitigation. round your answers to two decimal places. enter your answer for npv in millions. for example, an answer of $10,550,000 should be entered as 10.55. npv $ million irr %

Answers: 2

Another question on Business

Business, 21.06.2019 23:30

Minneapolis federal reserve bank economist edward prescott estimates the elasticity of the u.s. labor supply to be 3. given this elasticity, what would be the impact of funding the social security program with tax increases on the number of hours worked and on the amount of taxes collected to fund social security?

Answers: 2

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 12:50

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the u.s. treasury yield curve can take. check all that apply.

Answers: 2

Business, 22.06.2019 20:20

Trade will take place: a. if the maximum that a consumer is willing and able to pay is less than the minimum price the producer is willing and able to accept for a good. b. if the maximum that a consumer is willing and able to pay is greater than the minimum price the producer is willing and able to accept for a good. c. only if the maximum that a consumer is willing and able to pay is equal to the minimum price the producer is willing and able to accept for a good. d. none of the above.

Answers: 3

You know the right answer?

Nelectric utility is considering a new power plant in northern arizona. power from the plant would b...

Questions

Social Studies, 02.07.2019 02:30

History, 02.07.2019 02:30

Mathematics, 02.07.2019 02:30

Mathematics, 02.07.2019 02:30

Health, 02.07.2019 02:30

Mathematics, 02.07.2019 02:30

Mathematics, 02.07.2019 02:30

Mathematics, 02.07.2019 02:30

Geography, 02.07.2019 02:30

Chemistry, 02.07.2019 02:30