Business, 04.10.2019 20:20 lowemadison047

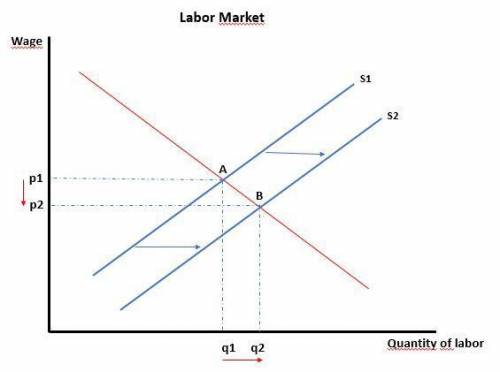

Y= f(k, l) = a k1/2l1/2 the data for this economy is a=10, k0=200 and the initial population is l0=200. we will assume that everyone in this country works so that population equals employment and per-person gdp equals per-worker gdp. note that each worker starts off with one unit of capital to work with. we will analyze the short-run effects of an inflow of immigrants into the economy. it is short-run effects because we will keep the stock of capital fixed at its initial value. suppose that in 2018 the economy receives a large inflow of immigration that increases the labor force by 10% to l1=220. to answer the following questions, draw diagrams on paper for the labor market and for the capital market. make sure you label your axes and curves carefully. label the initial equilibrium as point a. now shift the appropriate curves and draw the short-run equilibrium and label it as point b. in the labor market the supply shifts to the ; and the demand shifts to the

Answers: 1

Another question on Business

Business, 22.06.2019 17:30

Costco wholesale corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 471 locations across the u.s. as well as in canada, mexico and puerto rico. as of its fiscal year-end 2005, costco had approximately 21.2 million members. selected fiscal-year information from the company's balance sheets follows. ($ millions). selected balance sheet data 2005 2004 merchandise inventories $4,015 $3,644 deferred membership income (liability) 501 454 (a) during fiscal 2005, costco collected $1,120 cash for membership fees. use the financial statement effectstemplate to record the cash collected for membership fees. (b) in 2005, costco recorded $46,347 million in merchandise costs (that is, cost of goods sold). record thistransaction in the financial statement effects template. (c) determine the value of merchandise that costco purchased during fiscal-year 2005. use the financial statementeffects template to record these merchandise purchases. assume all of costco's purchases are on credit.

Answers: 3

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

Business, 23.06.2019 17:00

Ann and jack have been partners for several years. their​ firm, a​ & j tax​ preparation, has been very​ successful, as the pair agree on most​ business-related questions. one​ disagreement, however, concerns the legal form of their business. for the past two​ years, ann has tried to convince jack to incorporate. she believes that there is no downside to incorporating and sees only benefits. jack strongly​ disagrees; he thinks that the business should remain a partnership forever. ​ first, take​ ann's side, and explain the positive side to incorporating the business. ​ next, take​ jack's side, and state the advantages to remaining a partnership. ​ lastly, what information would you want if you were asked to make the decision for ann and​ jack? which of the following statements are the advantages of a partnership compared to a​ corporation? ​(choose all that​ apply.) a. less expensive to organize. b. ownership is readily transferable. c. lower income taxes. d. owners have limited liability. e. long life of firm.

Answers: 2

Business, 23.06.2019 20:10

Adog whistle manufacturer's factory was located near a residential area. the manufacturer used the most effective methods for testing its whistles, but it was impossible to completely soundproof the testing area. a breeder of champion show dogs bought some property near the factory and raised and trained her dogs there. although the whistles were too high-pitched to be perceived by human ears, they could be heard by the breeder's dogs. consequently, the dogs often were in a constant state of agitation. in a suit by the breeder against the manufacturer, what is the likely outcome? response - correct a the breeder will prevail on a trespass theory, because the sound waves are entering onto the breeder's property. b the breeder will prevail on a nuisance theory, because the sound of the whistles is a substantial interference with the breeder's use of her land. c the breeder will not prevail, because the sound of the whistles is not a substantial interference with the breeder's use of her land. d the breeder will not prevail, because the manufacturer has acted reasonably in testing its whistles.

Answers: 3

You know the right answer?

Y= f(k, l) = a k1/2l1/2 the data for this economy is a=10, k0=200 and the initial population is l0=2...

Questions

Law, 18.04.2020 22:27

Mathematics, 18.04.2020 22:27

Mathematics, 18.04.2020 22:27

Mathematics, 18.04.2020 22:27

Chemistry, 18.04.2020 22:27

Mathematics, 18.04.2020 22:27