Business, 16.10.2019 00:00 lukevader311

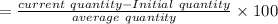

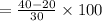

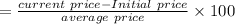

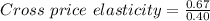

Last month, sellers of good y took in $100 in total revenue on sales of 50 units of good y. this month sellers of good y raised their price and took in $120 in total revenue on sales of 40 units of good y. at the same time, the price of good x stayed the same, but sales of good x increased from 20 units to 40 units. we can conclude that goods x and y are select one: a. complements, and have a cross-price elasticity of 0.60. b. substitutes, and have a cross-price elasticity of 1.67. c. substitutes, and have a cross-price elasticity of 0.60. d. complements, and have a cross-price elasticity of 1.67.

Answers: 2

Another question on Business

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 19:40

An increase in the market price of men's haircuts, from $16 per haircut to $26 per haircut, initially causes a local barbershop to have its employees work overtime to increase the number of daily haircuts provided from 20 to 25. when the $26 market price remains unchanged for several weeks and all other things remain equal as well, the barbershop hires additional employees and provides 40 haircuts per day. what is the short-run price elasticity of supply? nothing (your answer should have two decimal places.) what is the long-run price elasticity of supply? nothing (your answer should have two decimal places.)

Answers: 1

Business, 23.06.2019 01:00

Need with an adjusting journal entrycmc records depreciation and amortization expense annually. they do not use an accumulated amortization account. (i.e. amortization expense is recorded with a debit to amort. exp and a credit to the patent.) annual depreciation rates are 7% for buildings/equipment/furniture, no salvage. (round to the nearest whole dollar.) annual amortization rates are 10% of original cost, straight-line method, no salvage. cmc owns two patents: patent #fj101 and patent #cq510. patent #cq510 was acquired on october 1, 2016. patent #fj101 was acquired on april 1, 2018 for $119,000. the last time depreciation & amortization were recorded was december 31, 2017.before adjustment: land: 348791equpment and furniture: 332989building: 876418patents 217000

Answers: 3

Business, 23.06.2019 11:40

Mandela manufacturing thinks that the best activity base for its manufacturing overhead is machine hours. the estimate of annual overhead costs is $540,000. the company used 1,000 hours of processing for job a15 during the period and incurred actual overhead costs of $580,000. the budgeted machine hours for the year totaled 20,000. what amount of manufacturing overhead should be applied to job a15? $29,000. $540. $580. $27,000.

Answers: 2

You know the right answer?

Last month, sellers of good y took in $100 in total revenue on sales of 50 units of good y. this mon...

Questions

World Languages, 19.08.2020 09:01

Arts, 19.08.2020 09:01

English, 19.08.2020 09:01

Health, 19.08.2020 09:01

Biology, 19.08.2020 09:01

Computers and Technology, 19.08.2020 09:01

Social Studies, 19.08.2020 09:01

Biology, 19.08.2020 09:01

Mathematics, 19.08.2020 09:01