Business, 18.10.2019 04:20 tylorroundy

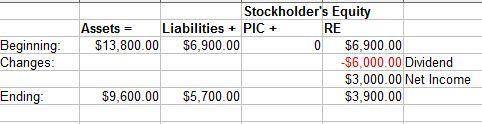

At the beginning of its current fiscal year, willie corp.’s balance sheet showed assets of $10,100 and liabilities of $6,900. during the year, liabilities decreased by $1,200. net income for the year was $3,000, and net assets at the end of the year were $3,900. there were no changes in paid-in capital during the year. required: calculate the dividends, if any, declared during the year. indicate the financial statement effect. (enter decreases with a minus sign to indicate a negative financial statement effect.)

Answers: 2

Another question on Business

Business, 21.06.2019 12:30

If research reveals that a company has a large number of unresolved complaints and a poor business rating, which external source did you most likely use during this research? a. blogs b. better business bureau c. social media d. local chamber of commerce e. mint global

Answers: 3

Business, 22.06.2019 02:00

Corporations with suppliers, vendors, and customers all over the globe are referred to as : a) global corporations b) international corporations c) multinational corporations d) multicultural corporations

Answers: 2

Business, 22.06.2019 03:30

Tiana daniels enterprise’s trial balance as at december 31, 2016 did not balance. on february 15, 2017 the following errors were detected: errorsi. water rates had been undercast by $2, 000. ii. a cheque paid to yvonne walch of $2, 680 had been posted to the credit side of her account. iii. discount received total of $1, 260 had been posted to the debit side of the discount allowed account as $1, 620. iv. rent paid in the amount of $24, 000 had been posted to the credit of the rent received account. v. wayne returned goods valuing $1, 680 to daniels enterprise but had been completely omitted from the books. required: 1. prepare the journal entries to correct the errors. (narrations required) 14.5 marks 2. prepare the suspense account showing clearly the original trial balance error. 8 marks

Answers: 2

Business, 22.06.2019 06:30

If a seller prepaid the taxes of $4,400 and the closing is set for may 19, using the 12 month/30 day method what will the buyer owe the seller as prorated taxes?

Answers: 1

You know the right answer?

At the beginning of its current fiscal year, willie corp.’s balance sheet showed assets of $10,100 a...

Questions

Mathematics, 18.12.2020 17:30

Business, 18.12.2020 17:30

Computers and Technology, 18.12.2020 17:30

Biology, 18.12.2020 17:30

Mathematics, 18.12.2020 17:30

Arts, 18.12.2020 17:30

Mathematics, 18.12.2020 17:30

Mathematics, 18.12.2020 17:30