Mr. williams is employed by bdf inc. compute bdf’s 2017 employer payroll tax with respect to mr. williams assuming that:

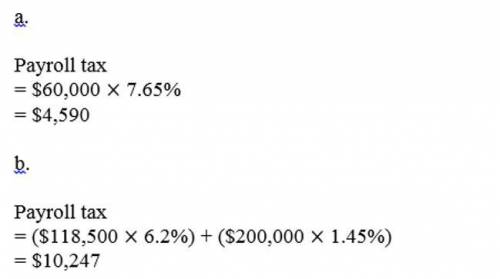

a. compute bdf’s 2019 employer payroll tax with respect to mr. williams assuming that his annual compensation is $60,000.

b. compute bdf’s 2019 employer payroll tax with respect to mr. williams assuming that his annual compensation is $200,000.

Answers: 2

Another question on Business

Business, 21.06.2019 23:00

The company financial officer was interested in the average cost of pcs that had been purchased in the past six months. she took a random sample of the price of 10 computers, with the following results. $3,250, $1,127, $2,995, $3,250, $3,445, $3,449, $1,482, $6,120, $3,009, $4,000 what is the iqr?

Answers: 2

Business, 22.06.2019 01:10

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

Business, 22.06.2019 09:50

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

Business, 22.06.2019 11:00

Which ranks these careers that employers are most likely to hire from the least to the greatest?

Answers: 2

You know the right answer?

Mr. williams is employed by bdf inc. compute bdf’s 2017 employer payroll tax with respect to mr. wil...

Questions

Physics, 15.07.2019 22:20

Law, 15.07.2019 22:20