Business, 28.11.2019 04:31 thisismyusername875

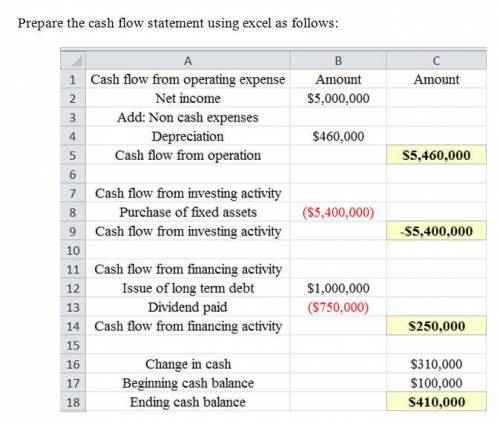

You have just been hired as a financial analyst for barrington industries. unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire. so, your first job will be to recreate the firm's cash flow statement for the year just ended. the firm had $100,000 in the bank at the end of the prior year, and its working capital accounts except cash remained constant during the year. it earned $5 million in net income during the year but paid $750,000 in dividends to common shareholders. throughout the year, the firm purchased $5.5 million of machinery that was needed for a new project. you have just spoken to the firm's accountants and learned that annual depreciation expense for the year is $450,000; however, the purchase price for the machinery represents additions to property, plant, and equipment before depreciation. finally, you have determined that the only financing done by the firm was to issue long-term debt of $1 million at a 6% interest rate. what was the firm's end-of-year cash balance? recreate the firm's cash flow statement to arrive at your answer. write out your answer completely. for example, 5 million should be entered as 5,000,000. round your answer to the nearest dollar, if necessary.

Answers: 2

Another question on Business

Business, 22.06.2019 07:00

Bridgeport company began operations at the beginning of 2018. the following information pertains to this company. 1. pretax financial income for 2018 is $115,000. 2. the tax rate enacted for 2018 and future years is 40%. 3. differences between the 2018 income statement and tax return are listed below: (a) warranty expense accrued for financial reporting purposes amounts to $7,500. warranty deductions per the tax return amount to $2,200. (b) gross profit on construction contracts using the percentage-of-completion method per books amounts to $94,700. gross profit on construction contracts for tax purposes amounts to $67,100. (c) depreciation of property, plant, and equipment for financial reporting purposes amounts to $61,800. depreciation of these assets amounts to $75,700 for the tax return. (d) a $3,600 fine paid for violation of pollution laws was deducted in computing pretax financial income. (e) interest revenue recognized on an investment in tax-exempt municipal bonds amounts to $1,500. 4. taxable income is expected for the next few years. (assume (a) is short-term in nature; assume (b) and (c) are long-term in nature.) (a) prepare the reconciliation schedule for 2017 and future years. (b) prepare the journal entry to record income tax expense for 2017. (c) prepare the income tax expense section of the income statement beginning with “income before income taxes.” (d) determine how the deferred taxes will appear on the balance sheet at the end of 2017.

Answers: 1

Business, 22.06.2019 07:10

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 17:30

What is the sequence of events that could lead to trade surplus

Answers: 3

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

You know the right answer?

You have just been hired as a financial analyst for barrington industries. unfortunately, company he...

Questions

Mathematics, 06.07.2020 20:01

Chemistry, 06.07.2020 20:01

Computers and Technology, 06.07.2020 20:01

Computers and Technology, 06.07.2020 20:01

Mathematics, 06.07.2020 20:01

Computers and Technology, 06.07.2020 20:01

Mathematics, 06.07.2020 20:01

Mathematics, 06.07.2020 20:01

History, 06.07.2020 20:01

Mathematics, 06.07.2020 20:01

Mathematics, 06.07.2020 20:01

Physics, 06.07.2020 20:01

Mathematics, 06.07.2020 20:01

History, 06.07.2020 20:01