Business, 30.11.2019 06:31 hernandezbrandon059

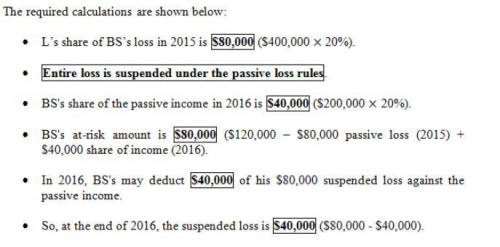

Anumber of years ago, lee acquired a 20% interest in the bluesky partnership for $60,000. the partnership was profitable through 2018, and lee's amount at risk in the partnership interest was $120,000 at the beginning of 2019. bluesky incurred a loss of $400,000 in 2019 and reported income of $200,000 in 2020. assuming that lee is not a material participant, how much of his loss from bluesky partnership is deductible in 2019 and 2020? consider the at-risk and passive activity loss rules, and assume that lee owns no other passive investments.

Answers: 2

Another question on Business

Business, 21.06.2019 22:10

3. now assume that carnival booked lady antebellum in december 2016 to perform on the june 2017 western caribbean cruise. further assume that carnival pays lady antebellum its entire performance fee of $52,000 on december 28, 2016, for the june 2017 cruise. what journal entry will carnival make on december 28, 2016, for its payment to lady antebellum?

Answers: 1

Business, 22.06.2019 12:50

Demand increases by less than supply increases. as a result, (a) equilibrium price will decline and equilibrium quantity will rise. (b) both equilibrium price and quantity will decline. (c) both equilibrium price and quantity will rise

Answers: 3

Business, 22.06.2019 14:30

Your own record of all your transactions. a. check register b. account statement

Answers: 1

Business, 22.06.2019 14:50

One pound of material is required for each finished unit. the inventory of materials at the end of each month should equal 20% of the following month's production needs. purchases of raw materials for february would be budgeted to be:

Answers: 2

You know the right answer?

Anumber of years ago, lee acquired a 20% interest in the bluesky partnership for $60,000. the partne...

Questions

Mathematics, 22.05.2020 03:03

Mathematics, 22.05.2020 03:04

Mathematics, 22.05.2020 03:04

Mathematics, 22.05.2020 03:04

Chemistry, 22.05.2020 03:04