Answers: 1

Another question on Business

Business, 22.06.2019 03:00

What is the relationship between marginal external cost, marginal social cost, and marginal private cost? a. marginal social cost equals marginal private cost plus marginal external cost. b. marginal private cost plus marginal social cost equals marginal external cost. c. marginal social cost plus marginal external cost equals marginal private cost. d. marginal external cost equals marginal private cost minus marginal social cost. marginal external cost a. is expressed in dollars, so it is not an opportunity cost b. is an opportunity cost borne by someone other than the producer c. is equal to two times the marginal private cost d. is a convenient economics concept that is not real

Answers: 3

Business, 22.06.2019 03:50

John is a 45-year-old manager who enjoys playing basketball in his spare time with his teenage sons and their friends. at work he finds that he is better able to solve problems that come up because of his many years of experience, but while on the court, he finds he is not as good keeping track of the ball while worrying about the other players. john's experience is:

Answers: 1

Business, 22.06.2019 04:00

Burberry is pursuing a focused differentiation strategy aimed at high-end luxury customers. however, the company is also employing a segmentation strategy to separate customers within that focus. the strategy offers items at an entry-level price point for customers who desire to be like celebrities such as sarah jessica parker as well as couture items for those richest and celebrity customers. what strategy is burberry pursuing?

Answers: 3

Business, 22.06.2019 07:40

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

You know the right answer?

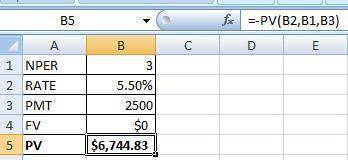

You have a chance to buy an annuity that pays $2,500 at the end of each year for 3 years. you could...

Questions

Mathematics, 09.03.2021 19:30

Mathematics, 09.03.2021 19:30

Computers and Technology, 09.03.2021 19:30

Social Studies, 09.03.2021 19:30

Mathematics, 09.03.2021 19:30

Mathematics, 09.03.2021 19:30

History, 09.03.2021 19:30

Mathematics, 09.03.2021 19:30

Social Studies, 09.03.2021 19:30

Mathematics, 09.03.2021 19:30