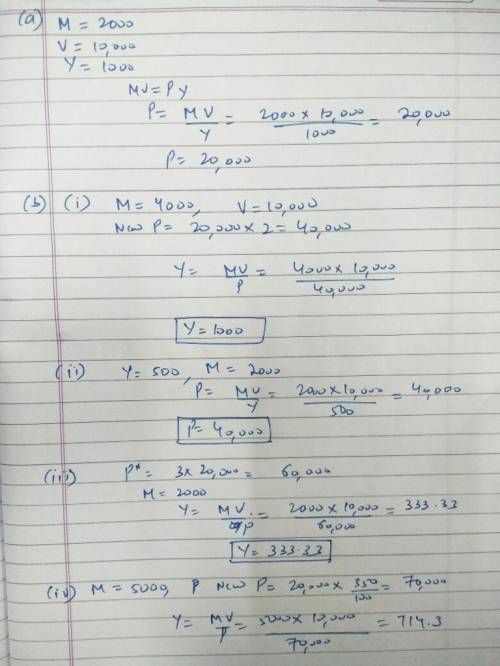

Your dormitory griffingate has appointed you central banker of its economy, which deals in the currency of wizcoins. assume that the velocity of wizcoins in griffingate is constant at 10,000 transactions per year. right now real gdp is 1,000 wizcoins, and there are 2,000 wizcoins in existence. what will be the value of each of the variables that make up the quantity equation? now indicate how the other variables will respond to each of the following scenarios, taking each case separately and assuming that velocity remains constant. you increase the money supply to 4,000, and prices increase twofold. start with the initial values. real gdp drops to 500 wizcoins, and the money supply remains constant. start with the initial values. prices increase threefold because of a sudden scarcity of soda, and you decide to keep the supply of wizcoins constant. start with the initial values. you increase the money supply to 5,000 wizcoins, and prices rise by 350 percent.

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

Business, 23.06.2019 00:20

Barney corporation recognized a $100 million preferred stock balance on 12/31/2019. on january 1, 2020, barney issued $10 million in preferred dividends. on the same date, barney raised an additional $20 million via a new issuance of preferred stock. on december 31, 2020, the market value of the original amount of preferred shares rose $5 million. under us gaap, the 12/31/2020 year ending preferred stock balance is:

Answers: 3

Business, 23.06.2019 03:00

If big macs were a durable good that could be costlessly transported between countries, which of the following would present an arbitrage opportunity? check all that apply. exporting big macs from argentina to the united states. exporting big macs from the united kingdom to poland. exporting big macs from switzerland to china

Answers: 1

You know the right answer?

Your dormitory griffingate has appointed you central banker of its economy, which deals in the curre...

Questions

History, 30.07.2021 22:50

Mathematics, 30.07.2021 22:50

Mathematics, 30.07.2021 22:50