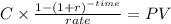

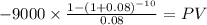

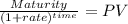

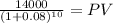

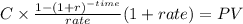

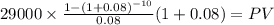

Kiddy toy corporation needs to acquire the use of a machine to be used in its manufacturing process. the machine needed is manufactured by lollie corp. the machine can be used for 10 years and then sold for $14,000 at the end of its useful life. lollie has presented kiddy with the following options (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.): (1) buy machine. the machine could be purchased for $164,000 in cash. all maintenance and insurance costs, which approximate $9,000 per year, would be paid by kiddy.(2) lease machine. the machine could be leased for a 10-year period for an annual lease payment of $29,000 with the first payment due immediately. all maintenance and insurance costs will be paid for by the lollie corp. and the machine will revert back to lollie at the end of the 10-year period. required: assuming that a 8% interest rate properly reflects the time value of money in this situation and that all maintenance and insurance costs are paid at the end of each year, find the present value for the following options. ignore income tax considerations.

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Maria am corporation uses the weighted-average method in its process costing system. the baking department is one of the processing departments in its strudel manufacturing facility. in june in the baking department, the cost of beginning work in process inventory was $4,880, the cost of ending work in process inventory was $1,150, and the cost added to production was $25,200. required: prepare a cost reconciliation report for the baking department for june.

Answers: 2

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

Business, 22.06.2019 21:00

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

You know the right answer?

Kiddy toy corporation needs to acquire the use of a machine to be used in its manufacturing process....

Questions

Mathematics, 09.07.2019 10:30

Mathematics, 09.07.2019 10:30

Mathematics, 09.07.2019 10:30

Biology, 09.07.2019 10:30

Advanced Placement (AP), 09.07.2019 10:30

Mathematics, 09.07.2019 10:30

Health, 09.07.2019 10:30

English, 09.07.2019 10:30

Biology, 09.07.2019 10:30

Mathematics, 09.07.2019 10:30

Mathematics, 09.07.2019 10:30