Business, 17.01.2020 22:31 ralucacoriciuc2482

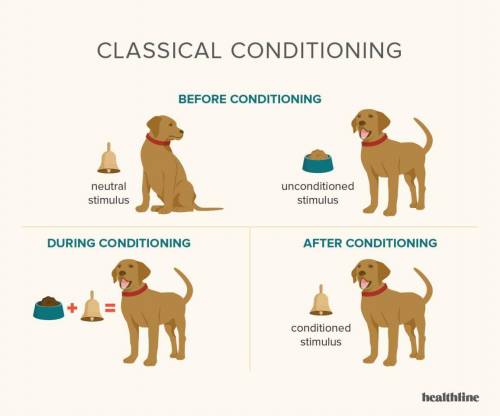

The final screen of the exercise mentioned advertisers' use of classical conditioning to form a positive connection to their brand in consumer's brains. according to the description, when doing so, advertisers are essentially utilizing their brand as a(

Answers: 1

Another question on Business

Business, 22.06.2019 01:20

Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $58. a, compute the percentage total return. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. what was the dividend yield and the capital gains yield? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Answers: 2

Business, 23.06.2019 07:30

What criteria does a company have to meet to be considered a monopoly?

Answers: 2

Business, 23.06.2019 15:10

Bramble corporation is a small wholesaler of gourmet food products. data regarding the store's operations follow:

Answers: 2

Business, 23.06.2019 17:30

Monthly price data for mdltx and ekwax from yahoo finance is contained in the excel spreadsheet for this exercise. there are 37 months of price data for the period from september 2009 to september 2012. (note: these prices already incorporate dividend payments.) the 36 monthly returns for each fund are also provided. calculate average (arithmetic) monthly return and standard deviation for each fund. you can use the excel functions average, stdev to derive these stats. annualize these statistics. use the correl function in excel to derive the correlation coefficient between the two sets of returns. (annual correlation is the same as monthly correlation. hence, no need to annualize this stat.) using the annualized statistics derived in step 1, compute the expected return and standard deviation for portfolios containing from 0% to 100% mdltx (and 100% to 0% ekwax) by 10% increments. graph the resulting portfolios. based on your analysis, is there any potential benefit to diversification across these two funds? explain. of the 11 portfolios you graphed, which are efficient?

Answers: 1

You know the right answer?

The final screen of the exercise mentioned advertisers' use of classical conditioning to form a posi...

Questions

History, 07.01.2021 18:10

Arts, 07.01.2021 18:10

Mathematics, 07.01.2021 18:10

Mathematics, 07.01.2021 18:10

Mathematics, 07.01.2021 18:10

Mathematics, 07.01.2021 18:10

Mathematics, 07.01.2021 18:10