Business, 25.01.2020 03:31 hannahdrees0731

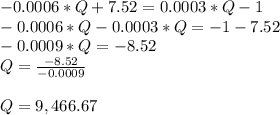

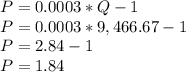

At a price of $1.94 per bushel, the supply of corn is 9,800 million bushels and the demand is 9,300 million bushels. at a price of $1.82 per bushel, the supply is 9,400 million bushels and the demand is 9,500 million bushels.

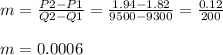

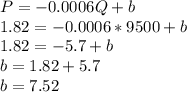

a) find a price-supply equation of the form p mx b, where p is the price in dollars and x is the corresponding supply in millions of bushels.

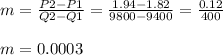

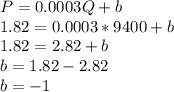

b) find a price-demand equation of the form p mxb, where p is the price in dollars and x is the corresponding supply in millions of bushels.

c) using excel, graph the price-supply and price-demand equations in the same coordinate system and find their point of intersection (equilibrium point)

Answers: 1

Another question on Business

Business, 22.06.2019 11:40

During 2016, nike inc., reported net income of $3,760 million. the company declared dividends of $1,022 million. the closing entry for dividends would include which of the following? select one: a. credit cash for $1,022 million b. credit dividends for $1,022 million c. debit net income for $1,022 million d. credit retained earnings for $1,022 million e. debit dividends for $1,022 million

Answers: 1

Business, 22.06.2019 17:30

Jeanie had always been interested in how individuals and businesses effectively allocate their resources in order to accomplish personal and organizational goals. that’s why she majored in economics and took on an entry-level position at an accounting firm. she is very interested in further advancing her career by looking into a specialization that builds upon her academic background, and her interest in deepening her understanding of how companies adjust their operating results to incorporate the economic impacts of their practices on internal and external stakeholders. which specialization could jeanie follow to get the best of both worlds? jeanie should chose to get the best of both worlds.

Answers: 2

Business, 22.06.2019 20:00

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

Business, 23.06.2019 02:50

Anderson farms, inc. provided the following for 2018: cost of goods sold (cost of sales)$1,300,000beginning merchandise inventory340,000ending merchandise inventory630,000calculate the company's inventory turnover ratio for the year. (round your answer to two decimal places.)

Answers: 2

You know the right answer?

At a price of $1.94 per bushel, the supply of corn is 9,800 million bushels and the demand is 9,300...

Questions

Advanced Placement (AP), 11.02.2020 20:53

Computers and Technology, 11.02.2020 20:53

Mathematics, 11.02.2020 20:53

Business, 11.02.2020 20:53

Biology, 11.02.2020 20:53

Mathematics, 11.02.2020 20:53

Biology, 11.02.2020 20:53

Physics, 11.02.2020 20:54

English, 11.02.2020 20:54