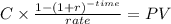

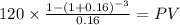

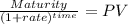

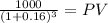

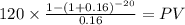

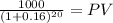

Consider two bonds, a 3-year bond paying an annual coupon of 12%, and a 20-year bond, also with an annual coupon of 12%. Both bonds currently sell at par value. Now suppose that interest rates rise and the yield to maturity of the two bonds increases to 16%. a. What is the new price of the 3-year bond? (Round your answer to 2 decimal places.) b. What is the new price of the 20-year bond? (Round your answer to 2 decimal places.) c. Do longer or shorter maturity bonds appear to be more sensitive to changes in interest rates? Longer Shorter

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

What is the key to success in integrating both lethal and nonlethal activities during planning? including stakeholders once a comprehensive operational approach has been determined knowing the commander's decision making processes and "touch points" including stakeholders from the very beginning of the design and planning process including the liaison officers (lnos) in all the decision points?

Answers: 1

Business, 22.06.2019 10:30

Describe three scenarios in which you might utilize mathematics to investigate a crime scene, accident scene, or to make decisions involving police practice. be sure to explain how math is used in police as they work through each scenario.

Answers: 1

Business, 22.06.2019 10:50

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 17:50

The management of a supermarket wants to adopt a new promotional policy of giving a free gift to every customer who spends > a certain amount per visit at this supermarket. the expectation of the management is that after this promotional policy is advertised, the expenditures for all customers at this supermarket will be normally distributed with a mean of $95 and a standard deviation of $20. if the management wants to give free gifts to at most 10% of the customers, what should the amount be above which a customer would receive a free gift?

Answers: 1

You know the right answer?

Consider two bonds, a 3-year bond paying an annual coupon of 12%, and a 20-year bond, also with an a...

Questions

Mathematics, 26.01.2020 04:31

History, 26.01.2020 04:31

English, 26.01.2020 04:31

Mathematics, 26.01.2020 04:31

Physics, 26.01.2020 04:31

Mathematics, 26.01.2020 04:31

Mathematics, 26.01.2020 04:31

English, 26.01.2020 04:31

Mathematics, 26.01.2020 04:31