Business, 26.02.2020 23:47 leannesmith90101

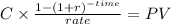

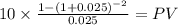

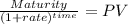

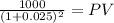

Suppose in 2017 you buy two year $1,000 face-value 2% coupon bond for $1,000. In 2018, interest rates increase to 5%. If you decide to sell your bond in 2018, what will be the selling price and one-year rate of return for you?

Answers: 1

Another question on Business

Business, 21.06.2019 13:30

List five words to describe your dominant culture. list five words to describe a culture with which you are not a member, have little or no contact, or have limited knowledge. can someone give me a example on how to answer this?

Answers: 1

Business, 22.06.2019 14:30

The state in which the manufacturing company you work for is located regulates the presence of a particular substance in the environment to concentrations ≤ x. recently-released, reliable research endorsed by the responsible federal agency conclusively demonstrates that the substance poses no risks at concentrations up to 5x. your company has asked you to consider designing a new process with a waste discharge stream containing up to 2x of the substance. based on the stated conditions, describe this possible.

Answers: 2

Business, 23.06.2019 00:50

On january 1 of the current year, jimmy's sandwich company reported owner's capital totaling $128,000. during the current year, total revenues were $106,000 while total expenses were $95,500. also, during the current year jimmy withdrew $30,000 from the company. no other changes in equity occurred during the year. if, on december 31 of the current year, total assets are $206,000, the change in owner's capital during the year was:

Answers: 3

You know the right answer?

Suppose in 2017 you buy two year $1,000 face-value 2% coupon bond for $1,000. In 2018, interest rate...

Questions

Mathematics, 23.10.2020 15:40

Biology, 23.10.2020 15:40

Social Studies, 23.10.2020 15:40

Health, 23.10.2020 15:40