Business, 28.02.2020 01:48 catuchaljean1623

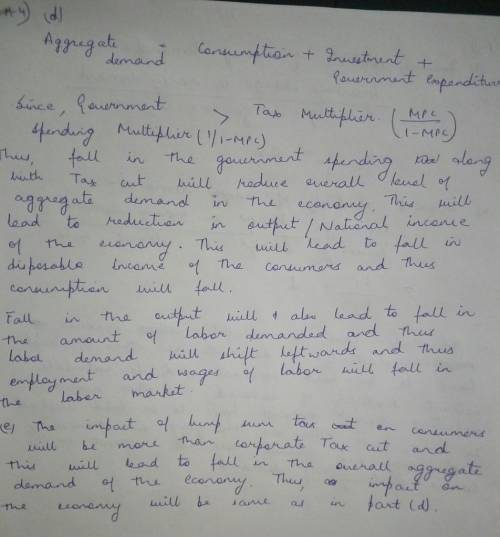

Consider an economy with one representative consumer, one representative firm and the government. Suppose that the consumer has one unit of labor and she supplies her labor inelastically. That means she works a fixed amount N, no matter what the wage is. The consumer's budget constraint is c = WN + Tt, and it is firm's profit. To simplify the question, assume the firm uses only labor input with the production function y = 2N1-4. The firm must pay a proportional tax on its revenue at tax rate Ty. The government funds its spending g from the corporate tax. a. Set up and solve for the firm's labor demand. Use diagram to determine the wage and employment in equilibrium. Now suppose that the government reduces the corporate tax. The corporate tax rate becomes t2 <11. b. What happens to the firm's labor demand? On the same diagram from (a), show the new labor market equilibrium. c. What happens to the consumption and output in equilibrium? Consider the fact that to fund the tax cut, the government must either reduce spending or increase some other tax. d. Suppose that the government reduces government spending by the amount needed to fund the tax cut. Now what happens on net to wages, employment, consumption and output?

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

On analyzing her company’s goods transport route, simone found that they could reduce transport costs by a quarter if they merged different transport routes. what role (job) does simone play at her company? simone is at her company.

Answers: 1

Business, 22.06.2019 19:30

He moto hotel opened for business on may 1, 2017. here is its trial balance before adjustment on may 31. moto hotel trial balance may 31, 2017 debit credit cash $ 2,283 supplies 2,600 prepaid insurance 1,800 land 14,783 buildings 72,400 equipment 16,800 accounts payable $ 4,483 unearned rent revenue 3,300 mortgage payable 38,400 common stock 59,783 rent revenue 9,000 salaries and wages expense 3,000 utilities expense 800 advertising expense 500 $114,966 $114,966 other data: 1. insurance expires at the rate of $360 per month. 2. a count of supplies shows $1,050 of unused supplies on may 31. 3. (a) annual depreciation is $2,760 on the building. (b) annual depreciation is $2,160 on equipment. 4. the mortgage interest rate is 5%. (the mortgage was taken out on may 1.) 5. unearned rent of $2,580 has been earned. 6. salaries of $810 are accrued and unpaid at may 31

Answers: 2

Business, 22.06.2019 20:00

An arithmetic progression involves the addition of the same quantity to each number.which might represent the arithmetic growth of agricultural production

Answers: 3

Business, 22.06.2019 20:30

Almeda products, inc., uses a job-order costing system. the company's inventory balances on april 1, the start of its fiscal year, were as follows:

Answers: 2

You know the right answer?

Consider an economy with one representative consumer, one representative firm and the government. Su...

Questions

Biology, 02.09.2020 20:01

Social Studies, 02.09.2020 20:01

History, 02.09.2020 20:01

Mathematics, 02.09.2020 20:01

Mathematics, 02.09.2020 20:01

History, 02.09.2020 20:01

Mathematics, 02.09.2020 20:01

Computers and Technology, 02.09.2020 20:01