Business, 29.02.2020 03:17 addisonrausch

On January 1, 2020, Monty Company purchased 10% bonds having a maturity value of $260,000, for $280,761.26. The bonds provide the bondholders with a 8% yield. They are dated January 1, 2020, and mature January 1, 2025, with interest received on January 1 of each year. Monty Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category.

1. Prepare the journal entry at the date of the bond purchase. (Enter answers to 2 decimal places, e. g. 2,525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

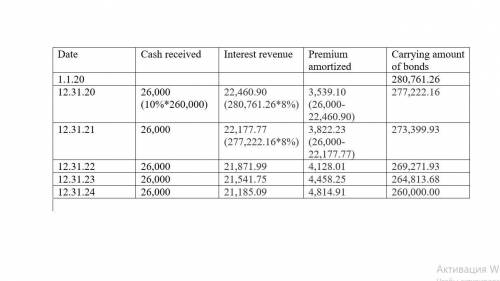

2. Prepare a bond amortization schedule. (Round answers to 2 decimal places, e. g. 2,525.25.)

3. Prepare the journal entry to record the interest revenue and the amortization at December 31, 2020. (Round answers to 2 decimal places, e. g. 2,525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

4. Prepare the journal entry to record the interest revenue and the amortization at December 31, 2021. (Round answers to 2 decimal places, e. g. 2,525.25. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Answers: 3

Another question on Business

Business, 21.06.2019 17:50

Identify which of the twelve basic functions listed below fit the description given.

Answers: 1

Business, 22.06.2019 10:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. ( t or f)

Answers: 1

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 11:00

Abank provides its customers mobile applications that significantly simplify traditional banking activities. for example, a customer can use a smartphone to take a picture of a check and electronically deposit into an account. this unique service demonstrates the bank’s desire to practice which one of porter’s strategies?

Answers: 3

You know the right answer?

On January 1, 2020, Monty Company purchased 10% bonds having a maturity value of $260,000, for $280,...

Questions

Mathematics, 07.12.2022 23:10

Social Studies, 07.12.2022 23:30

Mathematics, 08.12.2022 01:00

Biology, 08.12.2022 14:00

English, 08.12.2022 15:32

Social Studies, 08.12.2022 16:50

Geography, 08.12.2022 20:27

Mathematics, 09.12.2022 17:26

Mathematics, 09.12.2022 18:40

Computers and Technology, 10.12.2022 18:10

Medicine, 12.12.2022 03:10

Computers and Technology, 12.12.2022 05:20