Business, 07.03.2020 05:17 puppylover72

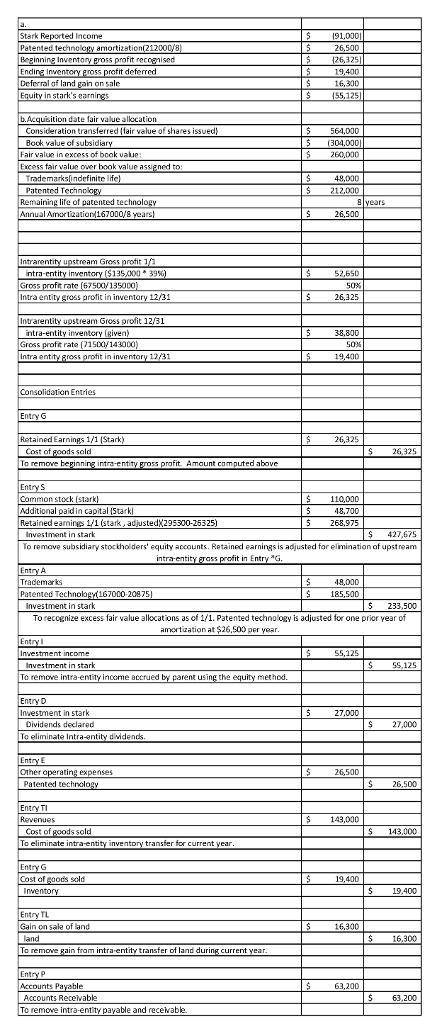

On January 1, 2017, Panther, Inc., issued securities with a total fair value of $564,000 for 100 percent of Stark Corporation's outstanding ownership shares. Stark has long supplied inventory to Panther. The companies expect to achieve synergies with production scheduling and product development with this combination.

Although Stark's book value at the acquisition date was $304,000, the fair value of its trademarks was assessed to be $48,000 more than their carrying amounts. Additionally, Stark's patented technology was undervalued in its accounting records by $212,000. The trademarks were considered to have indefinite lives, and the estimated remaining life of the patented technology was eight years.

In 2017, Stark sold Panther inventory costing $67,500 for $135,000. As of December 31, 2017, Panther had resold 61 percent of this inventory. In 2018, Panther bought from Stark $143,000 of inventory that had an original cost of $71,500. At the end of 2018, Panther held $38,800 (transfer price) of inventory acquired from Stark, all from its 2018 purchases.

During 2018, Panther sold Stark a parcel of land for $89,900 and recorded a gain of $16,300 on the sale. Stark still owes Panther $63,200 (current liability) related to the land sale.

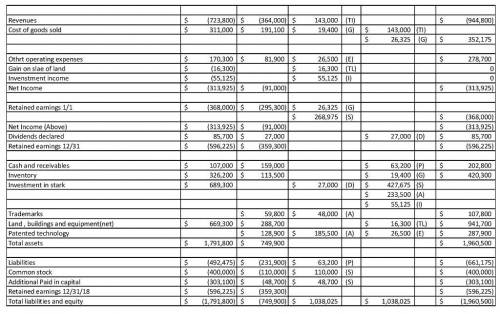

At the end of 2018, Panther and Stark prepared the following statements in preparation for consolidation.

Panther, Inc. Stark Corporation

Revenues $ (723,800 ) $ (364,000 )

Cost of goods sold 311,000 191,100

Other operating expenses 170,300 81,900

Gain on sale of land (16,300 ) 0

Equity in Stark's earnings (55,125 ) 0

Net income $ (313,925 ) $ (91,000 )

Retained earnings 1/1/18 $ (368,000 ) $ (295,300 )

Net income (313,925 ) (91,000 )

Dividends declared 85,700 27,000

Retained earnings 12/31/18 $ (596,225 ) $ (359,300 )

Cash and receivables $ 107,000 $ 159,000

Inventory 326,200 113,500

Investment in Stark 689,300 0

Trademarks 0 59,800

Land, buildings, and equip. (net) 669,300 288,700

Patented technology 0 128,900

Total assets $ 1,791,800 $ 749,900

Liabilities $ (492,475 ) $ (231,900 )

Common stock (400,000 ) (110,000 )

Additional paid-in capital (303,100 ) (48,700 )

Retained earnings 12/31/18 (596,225 ) (359,300 )

Total liabilities and equity $ (1,791,800 ) $ (749,900 )

Show how Panther computed its $55,125 equity in Stark's earnings balance.

Prepare a 2018 consolidated worksheet for Panther and Stark.

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

When is going to be why would you put money into saving account

Answers: 1

Business, 22.06.2019 05:30

Financial information that is capable of making a difference in a decision is

Answers: 3

Business, 22.06.2019 07:00

Amarket that consists of all possible consumers regardless of their specific needs or wants is a

Answers: 1

Business, 22.06.2019 08:40

Mcdonald's fast-food restaurants have a well-designed training program for all new employees. each new employee is supposed to learn how to perform standardized tasks required to maintain mcdonald's service quality. due to labor shortages in some areas, new employees begin work as soon as they are hired and do not receive any off-the-job training. this nonconformity to standards creates

Answers: 2

You know the right answer?

On January 1, 2017, Panther, Inc., issued securities with a total fair value of $564,000 for 100 per...

Questions

Mathematics, 07.10.2019 22:30

English, 07.10.2019 22:30

Mathematics, 07.10.2019 22:30

History, 07.10.2019 22:30

Biology, 07.10.2019 22:30

English, 07.10.2019 22:30

History, 07.10.2019 22:30