Business, 07.03.2020 20:24 jcross11nate

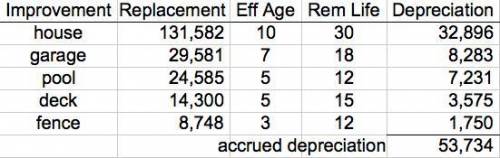

Anne Appraiser is determining the value of a single family residential home that has an

actual age of 15 years, an estimated effective age of 10 years, and a remaining economic

life of 30 years. The replacement cost is $131,582. A two-car garage was added to the

property ten years ago and has an effective age of 7 years with a remaining economic life

of 18 years. The replacement cost is $29,581. An inground pool was installed 3 years

ago, with an effective age of 5 years and a remaining economic life of 12 years. The

replacement cost is $24,585. The home has an extensive wooden deck constructed 5

years ago, with an effective age of 5 years, and a remaining economic life of 15 years.

The replacement cost is $14,300. Wooden fencing completely encloses the rear yard area

and has an effective age of 3 years and a remaining economic life of 12 years. The

replacement cost is $8,748. Determine the total accrued depreciation.

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

As manager of kids skids, meghan wants to develop her relationship management skills. in order to do this, she learns how to

Answers: 2

Business, 22.06.2019 11:40

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

Business, 22.06.2019 12:30

On june 1, 2017, blossom company was started with an initial investment in the company of $22,360 cash. here are the assets, liabilities, and common stock of the company at june 30, 2017, and the revenues and expenses for the month of june, its first month of operations: cash $4,960 notes payable $12,720 accounts receivable 4,340 accounts payable 840 service revenue 7,860 supplies expense 1,100 supplies 2,300 maintenance and repairs expense 700 advertising expense 400 utilities expense 200 equipment 26,360 salaries and wages expense 1,760 common stock 22,360 in june, the company issued no additional stock but paid dividends of $1,660. prepare an income statement for the month of june.

Answers: 3

Business, 22.06.2019 16:00

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

You know the right answer?

Anne Appraiser is determining the value of a single family residential home that has an

actual...

actual...

Questions

Chemistry, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20

English, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20

Mathematics, 12.11.2020 03:20