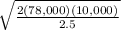

Your company imports decorative planters from Italy. Weekly demand is 1,500 units on average, with a standard deviation of 800. Each planter costs you $10, and the holding cost per year is 25%. You are using a distribution center in Arizona, and fixed transportation costs from Italy is $10,000 per order. Consider a 52-week/year operations. What is the optimal order quantity

Answers: 1

Another question on Business

Business, 22.06.2019 01:30

The gomez company, a merchandising firm, has budgeted its activity for december according to the following information: • sales at $500,000, all for cash. • merchandise inventory on november 30 was $250,000. • the cash balance at december 1 was $20,000. • selling and administrative expenses are budgeted at $50,000 for december and are paid for in cash. • budgeted depreciation for december is $30,000. • the planned merchandise inventory on december 31 is $260,000. • the cost of goods sold represents 75% of the selling price. • all purchases are paid for in cash. the budgeted cash disbursements for december are:

Answers: 3

Business, 22.06.2019 06:00

When an interest-bearing note comes due and is uncollectible, the journal entry includes debitingaccounts receivable and crediting notes receivable and interest revenue.accounts receivable and crediting interest revenue.notes receivable and crediting accounts receivable and interest revenue.notes receivable and crediting accounts receivable.

Answers: 3

Business, 22.06.2019 07:00

Bridgeport company began operations at the beginning of 2018. the following information pertains to this company. 1. pretax financial income for 2018 is $115,000. 2. the tax rate enacted for 2018 and future years is 40%. 3. differences between the 2018 income statement and tax return are listed below: (a) warranty expense accrued for financial reporting purposes amounts to $7,500. warranty deductions per the tax return amount to $2,200. (b) gross profit on construction contracts using the percentage-of-completion method per books amounts to $94,700. gross profit on construction contracts for tax purposes amounts to $67,100. (c) depreciation of property, plant, and equipment for financial reporting purposes amounts to $61,800. depreciation of these assets amounts to $75,700 for the tax return. (d) a $3,600 fine paid for violation of pollution laws was deducted in computing pretax financial income. (e) interest revenue recognized on an investment in tax-exempt municipal bonds amounts to $1,500. 4. taxable income is expected for the next few years. (assume (a) is short-term in nature; assume (b) and (c) are long-term in nature.) (a) prepare the reconciliation schedule for 2017 and future years. (b) prepare the journal entry to record income tax expense for 2017. (c) prepare the income tax expense section of the income statement beginning with “income before income taxes.” (d) determine how the deferred taxes will appear on the balance sheet at the end of 2017.

Answers: 1

Business, 22.06.2019 12:10

Drag each label to the correct location on the image determine which actions by a manager are critical interactions - listening to complaints - interacting with customers - responding to complaints - assigning staff duties -taking action to address customer grievances -keeping track of reservations

Answers: 2

You know the right answer?

Your company imports decorative planters from Italy. Weekly demand is 1,500 units on average, with a...

Questions

Mathematics, 09.10.2020 04:01

Biology, 09.10.2020 04:01

Social Studies, 09.10.2020 04:01

Mathematics, 09.10.2020 04:01

Mathematics, 09.10.2020 04:01

Mathematics, 09.10.2020 04:01

Computers and Technology, 09.10.2020 04:01