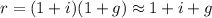

Suppose that over the past year, the real interest rate was 6 percent and the inflation rate was 4 percent. It follows thata. the dollar value of savings increased at 10 percent, and the purchasing power of savings increased at 6 percent. b. the dollar value of savings increased at 6 percent, and the purchasing power of savings increased at 2 percent. c. the dollar value of savings increased at 10 percent, and the purchasing power of savings increased at 2 percent. d. the dollar value of savings increased at 6 percent, and the purchasing power of savings increased at 10 percent.

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

Each of the four independent situations below describes a sales-type lease in which annual lease payments of $12,500 are payable at the beginning of each year. each is a finance lease for the lessee. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) situation 1 2 3 4 lease term (years) 3 3 3 3 asset’s useful life (years) 3 4 4 6 lessor’s implicit rate (known by lessee) 14 % 14 % 14 % 14 % residual value: guaranteed by lessee 0 $ 5,000 $ 2,500 0 unguaranteed 0 0 $ 2,500 $ 5,000 purchase option: after (years) none 2 3 3 exercise price n/a $ 7,500 $ 1,500 $ 3,500 reasonably certain? n/a no no yes

Answers: 1

Business, 22.06.2019 10:00

Scenario: you have advised the owner of bond's gym that the best thing to do would be to raise the price of a monthly membership. the owner wants to know what may happen once this price increase goes into effect. what will most likely occur after the price of a monthly membership increases? check all that apply. current members will pay more per month. the quantity demanded for memberships will decrease. the number of available memberships will increase. the owner will make more money. bond's gym will receive more membership applications.

Answers: 1

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

You know the right answer?

Suppose that over the past year, the real interest rate was 6 percent and the inflation rate was 4 p...

Questions

Arts, 14.01.2021 20:20

History, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20

English, 14.01.2021 20:20

Health, 14.01.2021 20:20

Chemistry, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20

Social Studies, 14.01.2021 20:20

History, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20

History, 14.01.2021 20:20

Health, 14.01.2021 20:20

World Languages, 14.01.2021 20:20

Mathematics, 14.01.2021 20:20